Which payment methods should you offer in e-commerce?

In e-commerce, the choice of payment methods directly conditions your success. It’s not just about processing a transaction, it’s about building the trust that underpins your sales and your image.

The payments landscape is constantly changing. Between the rise of fintechs, the weight of new regulations and increasingly demanding customer expectations, it’s no longer enough to add two or three standard options to your online store. Each payment solution must be considered as a key component of your strategy.

These choices have an immediate impact on your performance, in terms of customer flow, conversion rates, buyer satisfaction and loyalty. A clear and secure payment system is reassuring, whereas a confusing payment tunnel can break trust and slow down sales.

Which online payment methods should you adopt to meet consumer expectations while maximizing your revenues? We’ll help you find out!

Overview of online payment methods in 2025

In 2024, payment behavior was particularly varied. While credit cards remained the preferred method of payment for 89% of customers, 46% of shoppers also used an electronic payment solution, 37% a gift card or voucher, and 22% a bank transfer or direct debit¹. These key figures testify to the diversity of uses and the need to offer your customers several options.

In all, no fewer than seven different payment methods are used by the French today for their online purchases. It’s on these major solutions that we’re going to focus our analysis.

💡 Good to know 💡

If you sell B2B, your customers don’t have the same uses. Companies prefer solutions such as bank transfers or invoice settlements with deadlines, which facilitate cash management while establishing a more secure and lasting business relationship.

The credit card, the pillar of online payment

The credit card remains the number-one payment method in e-commerce. In 2024, 89% of online purchases in France were paid for by card. This figure illustrates the trust that consumers place in bankcards: they are familiar, easy to use and perceived as secure.

Whether credit, debit or prepaid, the card covers all buyer profiles. Major networks such as Visa, Mastercard and American Express reinforce this dominant position thanks to their reputation and the guarantees they provide.

European regulations have also consolidated this position.

The Payment Services Directive 2 (PSD2) makes strong authentication mandatory for the majority of transactions. The 3D Secure protocol (Visa Secure, Mastercard Identity Check) is the most visible application of this: it reduces fraud by confirming the buyer’s identity.

For e-commerce sites, two best practices are essential to secure card payments:

- Strong authentication: implementation of 3D Secure, now essential

- Data encryption: compliance with PCI DSS (Payment Card Industry Data Security Standard) standards for the processing, storage and transmission of banking information. Data encryption is not just a technical detail: it guarantees the protection of sensitive information and consolidates your customers’ trust.

💡 Good to know 💡

Selling on a marketplace like Rakuten means benefiting from the expertise of teams dedicated to payment security. All payment management is handled and secured upstream, allowing you to focus on your sales

Strong growth in electronic payment solutions

In 2024, 46% of online shoppers used an electronic payment solution, up 9 points in one year. This growth is explained by a simple expectation: pay quickly, especially on mobile, without having to re-enter your card.

E-wallets are the perfect answer to this need. An e-wallet stores your customers’ payment data and speeds up the checkout process. PayPal, Apple Pay, Google Pay and Lydia are among the most widely used services:

- Accelerate purchasing: one-click purchase validation, with data already recorded

- Simplify mobile payment: quick entry via Face ID/Touch ID

- Reinforce trust: no bank data entry on the merchant’s site

For e-commerce sellers, the benefits are just as clear. The main advantages are :

- Rapid conversion: fewer abandonments (biometric validation, no redirections)

- Smoother purchasing: improved experience (auto-fill, in-app payment)

- Additional sales: more impulse purchases and cross-selling

Payment facilities: an excellent conversion lever

Payment facilities allow your customers to spread out or defer their payments. A powerful argument when it comes to closing a major sale.

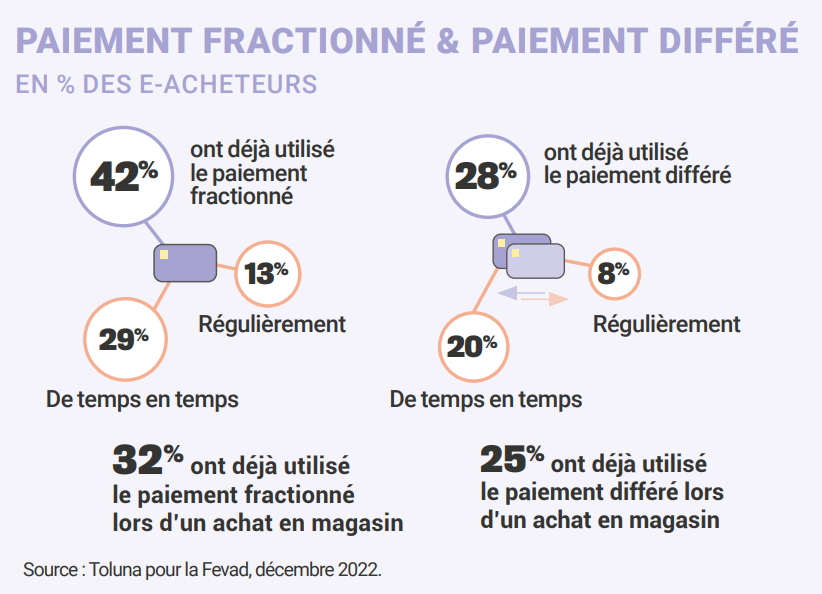

Still according to Fevad, in 2024, 42% of buyers opted for payment in instalments and 28% for deferred payment. These figures confirm that flexibility has become a real criterion of choice. The main payment facilities are :

- Payment in instalments (fractional payment): allows the buyer to spread the amount over monthly instalments.

– Advantage: makes expensive purchases accessible, increases the average shopping basket.

– Example: 3× free of charge on a €240 basket (3 × €80). - Deferred payment (Buy Now, Pay Later): purchase validated today, payment later.

– Advantage: gives the customer time to wait for payment.

– Example: pay within 30 days. - Direct debit: ideal for subscriptions and recurring services.

– Advantage: regular payments, with no action required on the customer’s side.

– Example: monthly renewal of a SaaS subscription. - Cash on delivery (COD): pay on delivery.

– Advantage: reassures reluctant buyers, zero down-payment.

– Example: hand delivery (cash/check), common in C2C (e.g. Leboncoin).

Fevad, key figures for e-commerce 2025

How do I select the right payment methods?

Payment methods are complementary: offering more will satisfy the maximum number of buyers.

- Your target: payment habits change according to generation and geographic zone. Ignoring these preferences risks losing some of your customers.

– For example, in France, bank cards are still the norm, while in the Netherlands, the majority of buyers prefer iDeal. - Your offer: the nature of the product and the size of the basket influence the choice. The higher the price, the greater the flexibility.

– For example, for a €1,200 computer, offering a split or deferred payment option will generate more sales. - Technical and security aspects: the payment API must integrate easily with your store and ensure a secure payment experience. Without it, you’ll increase friction and abandonment.

– Example: seamless integration with Shopify enables automatic transaction management and a more reliable user experience. - Costs: collection fees, PSP (Payment Service Provider) commissions and integration costs all have an impact on your margins. But removing an overpriced option can also slow down conversion.

– Example: accept a surcharge if the payment method actually increases your sales. - Internationalization: selling abroad means adopting local solutions and managing currency conversion. Neglecting this aspect will limit your opportunities. – Example: integrate Alipay to attract Chinese customers, with automatic conversion into euros.

Did you know that?

Rakuten relies on several payment partners specialized in e-commerce to facilitate multi-currency payments at competitive conditions, to support your international sales.

Optimize the payment experience to maximize conversions

A suitable payment method is an asset, but it’s the whole experience that makes the purchase a success. Here are the best practices to adopt:

- Smooth checkout. Reduce the number of steps and limit the number of fields. Offer a clear, legible interface, with help messages. On mobile devices, pay particular attention to ergonomics: adapted keyboard, auto-fill, large, visible buttons.

- Transparency and trust. Display available payment methods right from the start. Reassure customers with security logos and SCA/DSP2 notices.

- Efficient management. Provide access to payment history and send clear summary e-mails. Process refunds and cancellations without delay, with status visible at every stage.

- Personalization and choice. Offer relevant options according to buyer profile and country. Authorize data memorization (with consent) to activate one-click payment and facilitate customer loyalty.

- Dispute management. Define simple procedures for chargebacks and refunds. Set response times, centralize proof (tracking, proof of delivery) and inform the customer at each stage to anticipate disputes.

- Fraud prevention. Train your teams to recognize risk signals. Rely on a PSP equipped with an anti-fraud engine (real-time detection, adaptive 3D Secure, scoring, speed checks, device fingerprinting) and monitor your dispute KPIs.

Future payment trends

Four trends are already shaping the future of payments:

- Cryptocurrencies: their adoption is still limited, but already present in certain technophile sectors.

- Biometric payments: facial recognition and fingerprinting to enhance payment security.

- Embedded payments (IoT): connected cars or smart objects directly integrating the purchase option.

- Artificial intelligence: optimizing fraud detection and personalizing payment paths.

The final word

The choice of your payment methods is not an incidental question: it conditions the fluidity of your payment paths, the confidence of your customers and, ultimately, the growth of your sales.

Whether in France or abroad, your buyers expect options that are adapted to their usage, habits and purchasing power. If you ignore this reality, you run the risk of increasing cart abandonment and slowing down your expansion.

Opening up to foreign markets is also crucial. In particular, multi-currency payment enables you to expand your customer base while maintaining clear, competitive pricing. It’s a strategic lever to support your ambitions and gain in competitiveness.

Source :

¹Fevad, Chiffres clés du e-commerce 2025