Extended Producer Responsibility (EPR)

Since January 1, 2022, certain obligations contained in French law no. 2020-105 relating to the fight against waste and the circular economy (“AGEC”) have been applicable, and notably involve obtaining and transmitting a unique identifier (“IDU”). These obligations concern you even if you are simply a reseller of products on the platform.

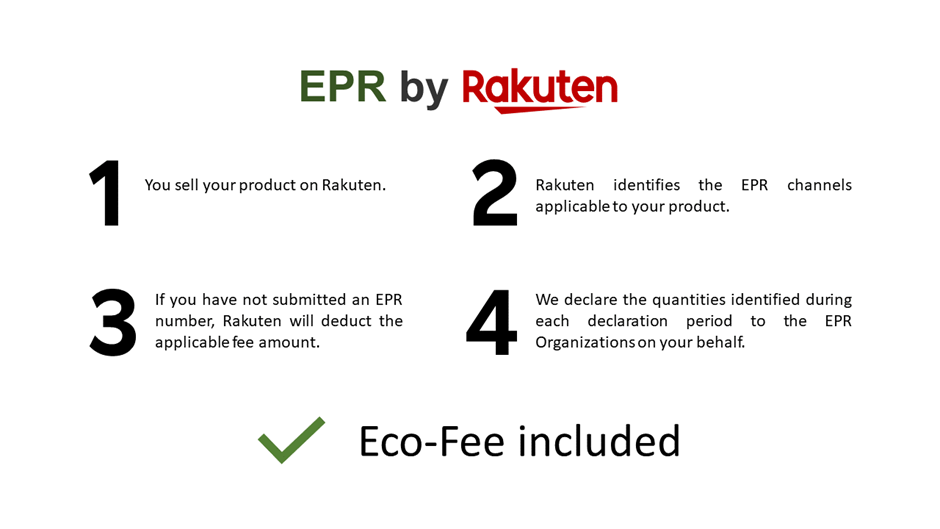

From October 09, 2023, Rakuten will provide you with its own default eco-contribution deduction mechanism for each of your sales on the Platform, based on the “we declare for you” principle. Find out more about how “REP by RAKUTEN” works on the dedicated help page.

Below you’ll find the key points to bear in mind from these recent EPR developments, and the steps you’re likely to need to take if you’re concerned.

Please note: This help section is purely informational and educational, and does not constitute an exhaustive and detailed summary of current regulations, nor a form of legal advice from Rakuten. Each seller is responsible for ensuring that his or her activity complies with current laws and regulations, and for taking the necessary steps on his or her own initiative.

The AGEC law extends the system of Extended Producer Responsibility (EPR) in France. Based on the “polluter pays” principle, EPR aims to make the manufacturer, seller or importer responsible for the various stages in the life of a product, from its creation to its reuse or recycling. To this end, the law makes it compulsory to join, pay an eco-contribution and declare to approved eco-organizations the products placed on the market in each sector.

The AGEC law makes it compulsory to join, pay a contribution and declare to approved eco-organizations the products placed on the market in each sector (the famous “ecocontribution”), in order to finance the end-of-life of the products that generate it. By joining the eco-organizations that cover the products you put on the French market for the first time, or by purchasing these products directly in France, you fulfill your obligations and obtain either your IDU or your supplier’s IDU. Note that if you operate on several marketplaces, all these identifiers are the same, as they are individual.

The law also obliges distributors of certain products to offer free take-back of a used product of the same type in exchange for the purchase of a new product (“1-for-1” take-back).

As a marketplace, we are unfortunately required by law to collect from our sellers their unique identifiers (“IDU(s)”), which certify that they are members of the aforementioned eco-organizations and therefore that your products comply with EPR, as well as, where applicable, their own 1-for-1 take-back solutions.

Rakuten allows you to include several aspects of EPR in your business by default, using EPR by RAKUTEN. Find out more on this page.

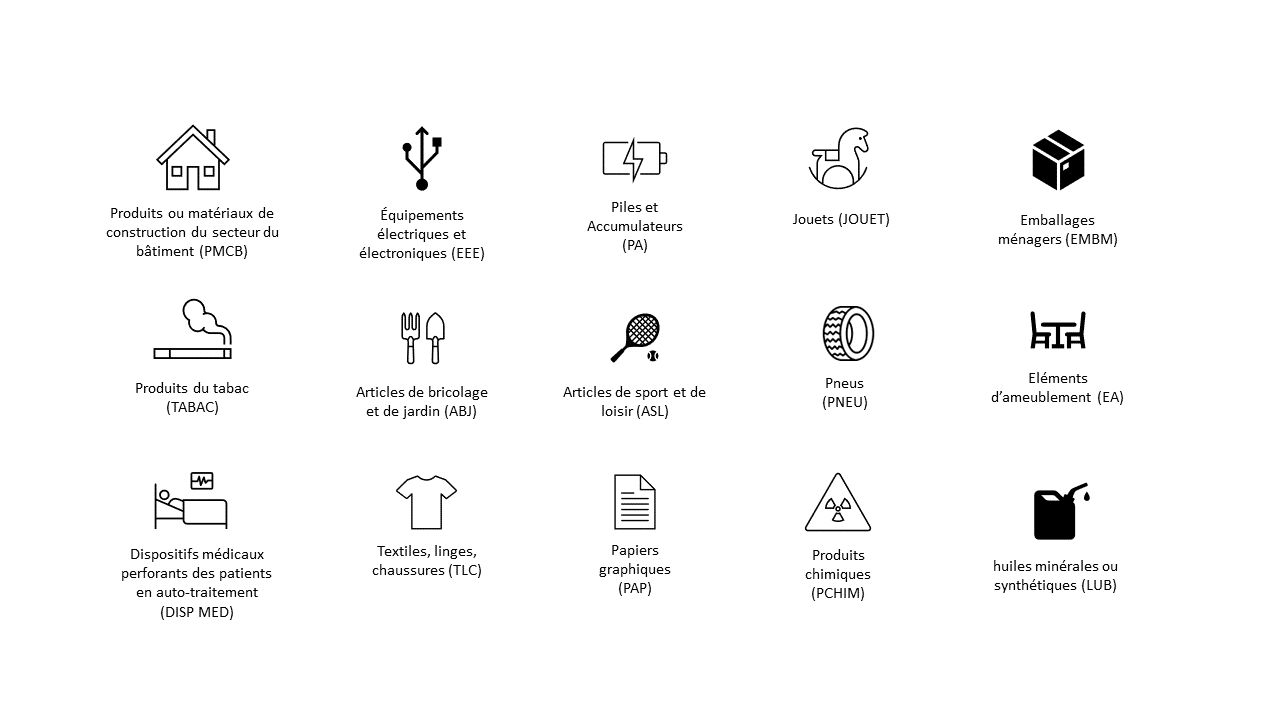

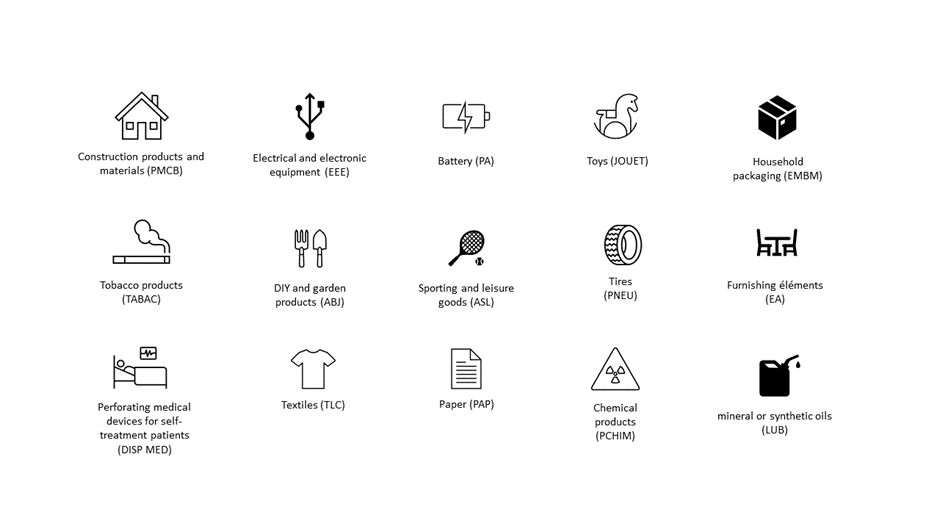

If you sell new products in different channels on Rakuten, chances are you’ll need to submit one or more IDUs. There are around twenty channels applicable in France, including the following:

Each of your sales in these channels will give you obligations linked to the AGEC law and EPR.

Each of your sales in these channels will give you obligations linked to the AGEC law and EPR.

Each of your sales in these channels will give you obligations linked to the AGEC law and EPR.

You are a Producer (in the legal sense) if you are the first to market a product on the

French market.

This is the case if you are, for example, the manufacturer (a manufacturer who sells under its

own brand name products made in France), the importer (who imports equipment from a

country outside the EU), the introducer (who imports equipment from a country outside the

EU), the distance seller (who sells equipment directly to remote households from abroad), or

the reseller (under your own brand name only), of the products concerned.

In this case, you are required to take all the necessary steps to comply with the law, which

gives you two options:

– Setting up an approved individual collection and treatment system, or ;

– Managing your obligations by joining the EPR Organizations approved for each industry, and

paying a financial contribution (Eco-Fee) in return.

So, to be compliant, you need to join the EPR Organizations for each industry in which you

sell your products:

| Industry | Category | Membership |

| Household electrical and electronic equipment industry (EEE) | EEE | ECOLOGIC |

| EEE, lamps | ECOSYSTEM | |

| Solar pannels | SOREN | |

| Packaging industry (EMBM) | EMBM | CITEO |

| EMBM | LEKO | |

| Batteries industry (PA) | PA | SCRELEC |

| PA | COREPILE | |

| Textile industry (TLC) | TLC | REFASHION |

| Toy industry (JOUET) | JOUET | ECOMAISON |

| Furniture industry (EA) | EA | VALDELIA |

| EA | ECOMAISON | |

| Sporting goods and leisure industry (ASL) | ASL | ECOLOGIC |

| Tire industry (PNEU) | PNEU | FRP |

| PNEU | ALIAPUR | |

| Chemical products industry (PCHIM) | categories 3 to 10 | ECODDS |

| Small fire extinguishers | ECOSYSTEM | |

| Pyrotechnic products | PYREO | |

| Oils and lubricants industry (LUB) | LUB | CYCLEVIA |

| Papers industry (PAP) | PAP | CITEO |

| Perforating medical devices for self-treatment patients industry (DISP MED) | DISP MED | DASTRI |

| DIY and gardening industry (ABJ) | category 2° – Thermal motorized machines and appliances |

ECOLOGIC |

| categories 3° – DIY equipment and 4° Products and equipment for garden maintenance and landscaping |

ECOMAISON | |

| category 1° – Painter’s tools | ECODDS | |

| Construction products and materials industry (PMCB) | Categories 1 and 2 | VALOBAT |

| Category 1 (Mineral products and materials) |

ECOMINERO | |

| Category 2 (Non-mineral products and materials) |

VALDELIA | |

| Category 2 (Non-mineral products and materials |

ECOMAISON | |

| Tobacco products industry (TABAC) | TABAC | ALCOME |

If you are a reseller of products that are already subject to the contribution, then even if you are not the first person to put them on the market, you can still resell products that fall within the scope of the law.

In this context, if you buy only and exclusively from French producers for each of the sectors in which you sell your products, you don’t have to take any steps yourself to join and pay the eco-contribution.

L’Article R541-167 2° du Code de l’environnement prévoit néanmoins, afin que nous puissions nous assurer de la conformité des produits, que vous nous fournissiez “[…] 2° l‘identifiant unique délivré en application de l’article L. 541-10-13 […] ou l’identifiant unique délivré au producteur du produit et qui a été communiqué au tiers proposant le produit à la vente conformément à l’article L. 541-10-10”.

However, Article R541-167 2° of the French Environment Code requires you to provide us with “[…] 2° l’identifiant unique délivré en application de l’article L. 541-10-13 […] ou l’identifiant unique délivré au producteur du produit et qui a été communiqué au tiers proposant le produit à la vente conformément à l’article L. 541-10-10″, so that we can ensure product compliance.

As a result, and because you are merely a “reseller” (the “third party offering the product for sale”), we ask you to retrieve the IDUs from your Producer, who will be legally obliged to communicate them to you in accordance with article L. 541-10-10 of the French Environment Code. In most cases, these IDUs can be accessed directly from their general terms and conditions of sale or on the dedicated Syderep search engine: https://syderep.ademe.fr/public/acteur/recherche?raisonSociale=&idUniqueFiliere=

Finally, you must be in possession of this IDU in all cases, should a buyer ask for it, in addition to having to pass on the exact price of the ecocontribution on your sales without any rebate (article L541-10-20 of the same code).

PLEASE NOTE: For simplicity’s sake, we’ll let you add just one number per channel (even if you have several suppliers). Choose the number of your most important supplier per channel, if applicable, or the one that seems most coherent.

Yes, as a matter of principle, EPR only applies to new products you have sold on French territory.

ATTENTION: As an online (distance) seller, even as a simple reseller, eco-organizations consider that the products you sell are packaged by you (even if they are second-hand). Packaging becomes subject to ecocontribution.

There are therefore two types of packaging:

- The product packaging itself, when it exists (otherwise known as “primary” packaging)

- Your product’s shipping parcel (otherwise known as “secondary” packaging).

Both types of packaging are part of the packaging chain. To help you meet your regulatory obligations, you can join directly:

- Citéo: https://www.citeo.com/

- Or Léko: https://www.leko-organisme.fr/

You can then directly fill in the IDU provided.

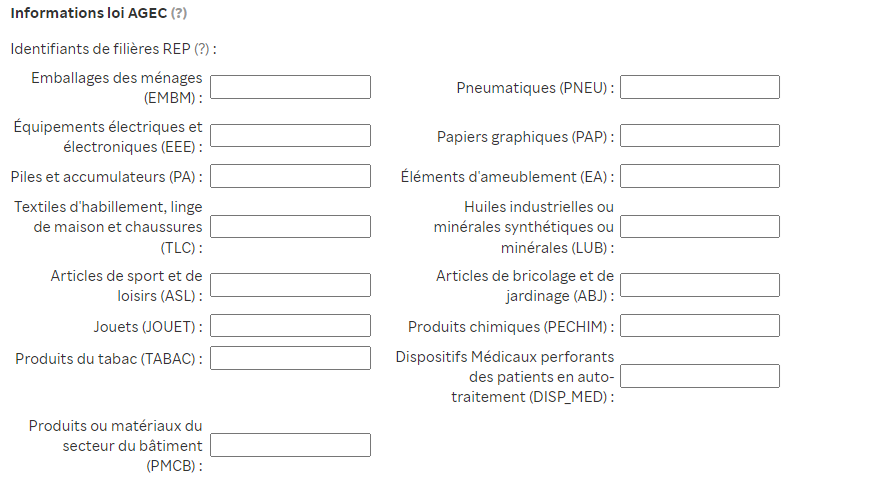

Once you have your IDUs for each of your channels, simply follow the steps below:

- Log in to your seller account.

- From your Merchant Center, go to the “Preferences” tab.

- In the “AGEC law information” section of your seller preferences, you can enter all the numbers you have.

- At the bottom of the page, click on “Validate”.

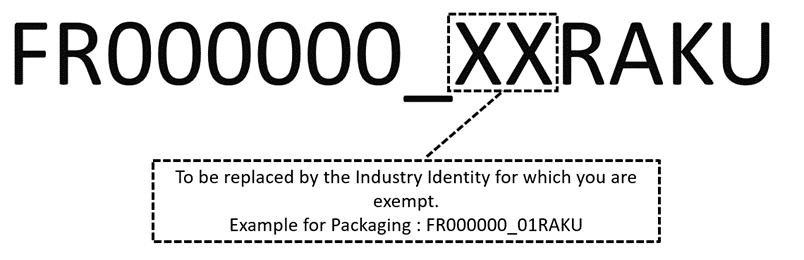

Please note: your numbers must respect the IDU format. This is made up of 15 characters, starting with FR, 6 digits, 1 “underscore”, then 2 digits (representing the die type identification code), and 4 random characters. Here’s an example of an IDU with the correct format:

Please note: your numbers must respect the IDU format. This is made up of 15 characters, starting with FR, 6 digits, 1 “underscore”, then 2 digits (representing the die type identification code), and 4 random characters. Here’s an example of an IDU with the correct format:

FR123456_XXPLRZ.

You must send your IDU to Rakuten as soon as possible, for each channel in which you sell your products. To do this, go directly to your seller area and enter your login details:

If you encounter a problem or if you have more than one IDU, because you are the reseller of different Producers or at the same time Producer and reseller or any other hypothesis, contact your account manager and send your IDUs explaining the problem.

If you sell products subject to EPR via the Rakuten platform without registering with an eco-organization and/or if you do not provide Rakuten with your unique identifier or any other evidence that you have fulfilled your waste prevention and management obligations, RAKUTEN will directly deduct the eco-contribution and pay it to the eco-organizations on your behalf through its “EPR by RAKUTEN” mechanism.

EPR by RAKUTEN” thus brings back the deduction of these amounts in real time, and constitutes the default mechanism for deducting the eco-tax from each of your sales on the Platform, in accordance with our Special Pro Conditions, which provide for the rebilling of all amounts paid on your behalf under the conditions set out in the Pro Price List.

These sales no longer need to be declared in your declarations to eco-organizations. However, this mechanism does not enable you to fulfill all your EPR obligations, and you remain responsible for ensuring that your activity complies with the laws and regulations in force, and for taking the necessary steps on your own initiative. This includes communicating your unique identifier.

For full details and explanations of this mechanism, please visit our dedicated help page.

If you sell products in a sector not concerned by “EPR by RAKUTEN”, and as indicated in the Special Pro Conditions, Rakuten will re-invoice you in full for the amounts paid on your behalf under the conditions set out in the Pro Fee Schedule, and in accordance with the collection scales of the eco-organizations.

ATTENTION: Rakuten will use estimates of your sales and simplified declaration scales, which will result in potentially much higher amounts than if you join and contribute on your own or with the help of a facilitator, and charges for managing your obligation on your behalf.

Please note:

This obligation to communicate an IDU applies not only to the Producer, but to all Marketplace sellers of products subject to one or more EPR schemes. In fact, the buyer of one of your EPR products is entitled to ask for your unique identifier. If so, you must provide it. If you are a reseller of products already on the market, be sure to ask for your supplier’s UID so that you can communicate it. See Section

Other resources are available in French from the following links:

- General framework for Extended Producer Responsibility: https://www.ecologie.gouv.fr/cadre-general-des-filieres-responsabilite-elargie-des-producteurs

- Extended Producer Responsibility (EPR) channels on the ADEME (French Agency for Ecological Transition) website: https://filieres-rep.ademe.fr/

- ADEME/SYDEREP FAQ: https://syderep.ademe.fr/faq

If you sell one or more of the following products, you are also subject to the obligation to take back used products from your buyers:

- Electrical and electronic equipment (WEEE) (cell phones, multimedia equipment (TVs, games consoles, etc.), small and large household appliances, computer hardware and accessories, lighting, DIY tools, etc.),

- Household chemicals and chemical containers (from January 1, 2022) (glue, solvents, household plant protection and biocide products, fertilizers, pyrotechnics, fire extinguishers, heating fuel, resins, paints, varnishes, coatings, cleaners and strippers, etc.),

- Furniture and furnishings (from January 1, 2022) (table, chair, garden furniture, sofa, bathroom furniture, bedding, etc.),

- Single-use combustible gas cartridges (from January 1, 2022).

- Toys (from January 1, 2023)

- Sporting and leisure goods (from January 1, 2023)

- DIY and garden items (from January 1, 2023)

Please note:

If the products you sell are transportable without equipment, then collection from a local collection point is sufficient. In any case, you must inform your customers when they place their order of the procedures for taking back used products.

I’m required to take back used products. What should I do with rakuten?

If you sell products subject to the EPR obligation (see section “Am I concerned by the EPR obligation?“), in addition to registering with an eco-organization (see section “I am subject to the EPR obligation – What do I have to do? “), you must offer to take back your used product or have it taken back, free of charge, in exchange for the purchase of a product of the same type (a “1-for-1” trade-in) (e.g., when buying a TV set, take back an old TV set of the same type). This trade-in can take place :

- At the point of delivery of the new product;

- Or at a collection point near the point of delivery of the new product;

- Or by providing a return solution for the buyer (e.g. postal service or equivalent), when the product’s characteristics allow this.

You can update this information in your seller preferences. Please also clearly state in your ad the conditions for taking back the used product, as indicated in the previous point.

If you do not take back a used product despite the buyer’s request, Rakuten may be required to cover the cost of taking back the product for you.

In such a case, as indicated in the Pro Special Conditions, Rakuten will re-invoice you for all amounts paid on your behalf under the conditions set out in the Pro Price List.

Please note:

Taking back the product is free of charge for the buyer. Take-back may be refused if the used product presents an unavoidable risk to the health and safety of take-back personnel. In this case, you must inform your purchaser of the alternative conditions for the take-back.

EPR by Rakuten

Eco participation included in your sales

EPR by RAKUTEN is the default mechanism for deducting the eco-contribution from each of your sales on the Platform on the “we declare for you” principle. Thus, if you sell Products on our Platform that fall within the scope of an EPR channel, without having previously communicated a valid IDU to us for whatever reason, RAKUTEN will directly deduct the amount of the eco-contribution and pay it to the eco-organizations on your behalf, within the limits of the thresholds defined by the latter. EPR by RAKUTEN also covers the 1-for-1 take-back of products covered by such take-back.

You will find the answers to your questions below on this page. If you cannot find an answer to one of your questions, please do not hesitate to contact us. In general, to find out more about EPR obligations, please consult our dedicated page. Other resources are available in French from the following links:

You will find the answers to your questions below on this page. If you cannot find an answer to one of your questions, please do not hesitate to contact us. In general, to find out more about EPR obligations, please consult our dedicated page. Other resources are available in French from the following links:

- General framework for Extended Producer Responsibility schemes.

- Les filières à Responsabilité élargie des producteurs (REP) on the ADEME (French Agency for Ecological Transition) website.

- ADEME/SYDEREP FAQ.

This help section describes the mechanism put in place by Rakuten to fulfill its regulatory obligations in accordance with article L541-10-9 of the French Environment Code. It in no way exempts professional sellers from all their legal EPR obligations, which are not limited to membership of eco-organizations and payment of the eco-contribution. Nor does it constitute an exhaustive, detailed summary of the regulations in force, or any form of legal advice on the part of Rakuten. In principle, each seller remains responsible for ensuring that his or her activity complies with current laws and regulations, and for taking the necessary steps on his or her own initiative. This includes providing the unique identifier.

The Extended Producer Responsibility (“EPR”) system is based on the “polluter pays”

principle. EPR aims to make the manufacturer, seller or importer responsible for the various

stages in the life of a product, from its creation to its reuse or recycling.

More generally, these provisions aim to finance all collection points, sorting, recycling and

reuse of all products covered by the law.

For information: EPR mainly takes the form of a contribution corresponding to part of the cost

price of your Product, intended to finance the prevention and management of the waste it

generates.

The products you sell are likely to be subject to EPR.

Indeed, if you sell under your own brand, or import or manufacture Products that fall within one of the many channels established by the AGEC law, as well as their packaging, you become subject to EPR and must contribute to the management of waste from your Products.

As a retailer, you are also subject to certain obligations, such as communicating the Producer’s IDU, and passing on the amount of the eco-contribution on each of your sales

without rebate.

In accordance with Article L541-10-1 of the French Environment Code, the main channels are as follows:

If you sell products through these channels, you are affected !

The law provides two options for compliance:

- Setting up an approved individual collection and treatment system, or ;

- Managing your obligations by becoming a member of the eco-organizations approved for each sector in which you are involved, and paying a financial contribution (Eco-participation) in return for fulfilling your obligations.

You need to join the eco-organizations for each sector in which you sell your products:

| Industry | Category | Membership |

| Household electrical and electronic equipment industry (EEE) | EEE | ECOLOGIC |

| EEE, lamps | ECOSYSTEM | |

| Solar pannels | SOREN | |

| Packaging industry (EMBM) | EMBM | CITEO |

| EMBM | LEKO | |

| Batteries industry (PA) | PA | SCRELEC |

| PA | COREPILE | |

| Textile industry (TLC) | TLC | REFASHION |

| Toy industry (JOUET) | JOUET | ECOMAISON |

| Furniture industry (EA) | EA | VALDELIA |

| EA | ECOMAISON | |

| Sporting goods and leisure industry (ASL) | ASL | ECOLOGIC |

| Tire industry (PNEU) | PNEU | FRP |

| PNEU | ALIAPUR | |

| Chemical products industry (PCHIM) | categories 3 to 10 | ECODDS |

| Small fire extinguishers | ECOSYSTEM | |

| Pyrotechnic products | PYREO | |

| Oils and lubricants industry (LUB) | LUB | CYCLEVIA |

| Papers industry (PAP) | PAP | CITEO |

| Perforating medical devices for self-treatment patients industry (DISP MED) | DISP MED | DASTRI |

| DIY and gardening industry (ABJ) | category 2° – Thermal motorized machines and appliances |

ECOLOGIC |

| categories 3° – DIY equipment and 4° Products and equipment for garden maintenance and landscaping |

ECOMAISON | |

| category 1° – Painter’s tools | ECODDS | |

| Construction products and materials industry (PMCB) | Categories 1 and 2 | VALOBAT |

| Category 1 (Mineral products and materials) |

ECOMINERO | |

| Category 2 (Non-mineral products and materials) |

VALDELIA | |

| Category 2 (Non-mineral products and materials |

ECOMAISON | |

| Tobacco products industry (TABAC) | TABAC | ALCOME |

IMPORTANT: As soon as you have joined and registered with SYDEREP, we invite you to upload your IDUs from your seller profile.

In collaboration with the eco-organizations, RAKUTEN has identified the Products in its catalog that fall under the various channels currently in force in France, as well as the amount of the associated simplified eco-contribution. As soon as you make your first sale of a Product subject to EPR on the Platform, RAKUTEN will identify the channels corresponding to this Product, check whether or not there is an IDU associated with your profile, and if not, automatically deduct the amount of the eco-contribution.

In this context, it is important to note that you are and remain solely responsible for the correct categorization of your Products on the Platform, and RAKUTEN will not be able to reimburse you for amounts deducted from Products not subject to EPR that you have incorrectly categorized. On the other hand, if you believe, after agreement with the eco-organizations, that your correctly categorized Product is not subject to EPR, you can inform our teams, who will study your particular case (I DISAGREE WITH THE CATEGORIZATION OF MY PRODUCTS, WHAT SHOULD I DO?).

RAKUTEN will then declare the quantities of Products sold to the eco-organizations and pay the eco-contributions on your behalf. Information on the amounts deducted can be accessed directly from your seller preferences.

In the future, Rakuten will provide you with the amounts of the levies within your accounting export accessible from your seller preferences, so that you can see which of your Products have been declared in your place, so that you do not do so and pay the eco-contribution twice.

If this is the case, we invite you to rectify your declarations to the eco-organizations, in order to withdraw the products concerned.

If you have any doubts, please contact our teams for further details.

Today, the list of channels supported by Rakuten and the trigger dates are shown in the “REP by RAKUTEN” scale. You’ll find the channels, the amounts and the declaration periods.

Products declared by Rakuten no longer have to be declared to eco-organizations, and you don’t have to pay the eco-contribution for them either.

Please note: This does not, however, relieve you of :

- Your EPR obligation for Products that Rakuten has not identified as belonging to one or other of the channels in force.

- Your EPR obligation for Products sold outside of Rakuten, on other websites, Marketplaces, or in your physical stores.

- Your other EPR obligations, including, but not limited to, the implementation of a Prevention and Eco-design Plan.

If you no longer wish to be levied on your products subject to EPR under French law, you have several options:

- Transmit your own IDUs: By fulfilling your regulatory obligations as a manufacturer, importer or seller under your own brand and adhering to the eco-organizations concerning the Products you offer for sale. All you then have to do is send Rakuten your identifiers as soon as possible, for each channel in which you sell your Products. To do this, go directly to your seller area and enter your IDs.

- Provide us with your suppliers’ IDUs: as a reseller, you must provide us with your main supplier’s IDU for each of the channels in which you sell.

- Remove from your catalog products subject to EPR on Rakuten. Eco-contribution amounts collected in the past are not refundable.

If you sell products which, by exception, are not subject to EPR, please consult the section: “My products have been wrongly collected, what should I do?

To find out more about obtaining an IDU and complying with the AGEC law, consult the section “I want to be compliant, what do I do?” or our dedicated help page.

The names of the eco-organizations to which Rakuten adheres and declares on your behalf, the declaration periods, and the amounts deducted per unit of sale to consumers can be accessed directly from the “EPR by RAKUTEN” scale.

Amounts are calculated by multiplying the number of your new Products sold in France, for which Rakuten has been able to associate an EPR Product category with its rate on the simplified scale of each eco-organization and for each Product channel and family.

ATTENTION: By exception, and specifically for the packaging channel, your Products sold second-hand or reconditioned are also concerned, in that their primary and secondary packaging are considered new on principle. You therefore become subject to this channel, unless your packaging is exempt according to the strict criteria defined by law and the eco-organization (see: My Products have been wrongly collected, what should I do?).

Please note: Rakuten uses simplified Product categories and declaration scales, which means higher fees than if you join and contribute on your own or with the help of a facilitator. The use of these simplified scales does not entitle you to any eco-modulation.

If you sell Products identified as being subject to EPR, but you are in fact neither a Producer nor a Reseller, you must indicate the following IDU to Rakuten in the fields of the channels for which you are exempt from said obligations:

Channel identities in accordance with article L541-10-1 of the environment code:

Channel identities in accordance with article L541-10-1 of the environment code:

| Chain | Identity | Chain | Identity |

| Electrical and electronic equipment (EEE) | 05 | Toys (TOY) | 12 |

| Batteries and accumulators (PA) | 06 | Mineral or synthetic lubricating or industrial oils (LUB) | 17 |

| DIY and gardening articles (ABJ) | 14 | Tyres (PNEU) | 16 |

| Household packaging (EMBM) | 01 | Chemical products (PCHIM) | 07 |

| Graphic papers (PAP) | 03 | Tobacco products (TABAC) | 19 |

| Clothing, household linen and footwear (TLC) | 11 | Perforating medical devices from self-treatment patients (DISP_MED) | 09 |

| Sporting and leisure goods (ASL) | 13 | Furnishings (EA) | 10 |

| Building sector products and materials (PMCB) | 04 | ||

| On January 1, 2024 | |||

| Chewing gum (GM) | 20 | Disposable sanitary textiles (TSUU) | 21 |

| On January 1, 2025 | |||

| Fishing gear (EP) | 22 | ||

ATTENTION: Entering this identifier means that your Products are exempt from EPR because they come entirely from re-use or meet the various conditions set by law and specified by the eco-organizations. Rakuten may conduct random audits and ask you for proof and justification.

If the levy is due to a wrong categorization of your Products, and not to their being reused, see the section below:

If you consider that your products are not subject to any channel, please follow the steps below:

- Check that you have correctly categorized your Product on our Platform, and in particular the information specific to certain channels (presence of a battery, thermal energy, electric, gas, wireless product, etc.).

- Check with the Eco-Organizations to make sure that your Products are not part of any EPR system.

- Contact our teams, indicating the products for which you are contesting the eco-contribution deduction.

- If your request is confirmed, we will proceed to regularize your situation for the past and the future, so that you can continue to sell with peace of mind.

Exceptionally, depending on cancellations, reporting periods, Product brackets and thresholds and eligibility for the simplified scale, recategorization of your Products and regulatory changes related to eco-organizations and EPR, Rakuten may be required to make adjustments to your sales in the event of overpayments or underpayments.

In addition, all your sales prior to the implementation of this mechanism (see the launch date for each sector in the Price List) will be billed retroactively in accordance with our Pro Price List.

Where applicable, you will be informed of this, together with all sales relating to these adjustments and the associated amounts.

In accordance with article 6. 4 of the Special Terms and Conditions for Professional Sellers, Rakuten reserves the right to re-invoice all amounts it may be required to pay as a result of a Professional Seller’s failure to comply with these regulations (including, including, but not limited to, any failure to pay the eco-participation fee, or any costs arising from a Buyer’s request to take back a used Product that have not been paid for by the Professional Seller). The supply of a fraudulent or non-compliant IDU may also give rise to such a chargeback.

If, for any reason, you sell Products on our Platform in categories subject to the 1 for 1 Trade-in system without having previously informed us of your Trade-in solution, RAKUTEN will handle the Trade-in for you within the limits of the categories managed by Rakuten’s partners.

Categories handled by Rakuten in the event that the seller fails to provide a take-back solution:

- Furniture over 20 KG.

In this case, Rakuten is obliged to pay the costs of the trade-in on your behalf. In this case, as indicated in the Pro Special Conditions, Rakuten will re-invoice you in full for the amounts paid on your behalf in accordance with the conditions set out in the Pro Price List. Service charges may also apply.

Legal guarantee of conformity

|

Please note that:

We remind that, RAKUTEN’s contribution to the development of this Frequently Asked Questions (FAQ) is only a brief and non-exhaustive presentation of the legislation concerned. Therefore, this FAQ does not in any way constitute legal advice from RAKUTEN.

|

For more information about the legal guarantee of conformity, we invite you to consult articles L.217-3 and following of the French Consumer code.

YES. All professional sellers, even if they are not established in France, are concerned from the moment when the sale of their goods is intended for a public of french consumers.

In particular, the following may constitute a lack of conformity :

- A difference between the product received by the buyer and the description that was given in your advert ;

- A malfunction of the good received by the buyer ;

- If the good received by the buyer does not correspond to the use normally expected ;

- If the good received by the buyer is not received with all its accessories or notice of installation.

More broadly, all cases listed in articles L.217-3, L.217-4 and L.217-5 of the french Consumer code may constitute lack of conformity.

In the event of notification of a lack of conformity, you are required to repair, replace the goods sold (according to the specifications of the buyer), or refund the buyer ; within a maximum period of 30 days from the request, without any cost to the latter.

For more information, we invite you to consult articles L.217-8, L.217-10 and L.217-11 of the French Consumer code.

You are required to deliver a compliant product and ensure its conformity within 2 years from the date of its receipt by the buyer.

|

It should be noted that, even if you no longer operate activity on RAKUTEN platform, you are nevertheless required to ensure the conformity of the good. |

Furthermore, in the event of repair of the product under the legal guarantee of conformity, a six-month warranty extension is provided for the benefit of the buyer. During this additional period of six months, you will be required to continue to ensure the conformity of the product at the request of the buyer.

For more information, we invite you to consult articles L.217-3 and L.217-13 of the French Consumer code.

NO. The conformity of the good must be executed without any cost to buyer. The latter cannot be required to pay for the normal use of the good.

In addition, you are required to take charge of the fees of re-expedition of the product by the buyer.

For more information, we invite you to consult articles L.217-10 and L.217-11 of the french Consumer code.

Buyer can, for a period of 2 years, prove the lack of conformity of the new product that you sold him/her, by any means (by sending photos, videos, expert reports, etc.).

Regarding second-hand good (including refurbished one), the buyer may prove the lack of conformity by any means for a period of 12 months. Beyond that, the buyer will have to prove that the lack of conformity existed on the date of receipt of the product.

For more information, we invite you to consult article L.217-8 of the French Consumer code.

Right of withdrawal

|

Please note that:

We remind that, RAKUTEN’s contribution to the development of this Frequently Asked Questions (FAQ) is only a brief and non-exhaustive presentation of the legislation concerned. Therefore, this FAQ does not in any way constitute legal advice from RAKUTEN.

|

YES. All professional sellers, established or not in France, are required to respect the provisions relating to the right of withdrawal of articles L.221-18 and following of the french Consumer code, from the moment when the sale of their goods is intended for a public of French consumers.

NO. As explained by article221-28 of the french Consumer code, the right of withdrawal cannot be exercised in the 13 cases restrictively listed :

NO. The legislator is clear on this subject and expressly specifies that the consumer can exercise its right of withdrawal without having to justify its decision.

For more information, we invite you to consult article L.221-18 of the French Consumer code.

On the one hand, the buyer has the possibility of exercising its right of withdrawal within 14 days starting from the receipt of the product.

It is also specified that in the case of an order relating to several products delivered separately or in the case of an order for a product composed of lots or multiple pieces whose delivery is staggered over a defined period, the short period starts from the receipt of the last product or lot or the final piece.

On the other hand, the buyer must return the products to you without undue delay and, not later than 14 days from the communication of its decision to withdraw.

For more information, we invite you to consult articles L.221-18 and L.221-23 of the French Consumer code.

The buyer can exercise its right of withdrawal by any means if his wish to withdraw is clearly expressed and is unambiguous (sending the withdrawal form, message addressed to you in the post-sale messaging service, contacting RAKUTEN customer service, etc.).

For more information, we invite you to consult article L.221-21 of the French Consumer code.

YES. The normal use of the product sold does not affect the benefit of the right of withdrawal. You are required to comply with the buyer’s request made within the legal deadlines.

Although, the legislator indicates that the consumer can only be responsible in case of depreciation of the goods resulting from manipulations other than those necessary to establish the nature, the characteristics, and the proper functioning of these goods.

For more information, we invite you to consult article L.221-23 of the French Consumer code.

In principle, when the buyer makes use of its right of withdrawal, as a professional seller, you are required to refund the price of the product as well as the delivery costs, within a maximum period of 14 days from the communication of the decision to withdraw.

You also have the possibility to refund the buyer only upon receipt of the products subject to a withdrawal, or, when the buyer provides proof of shipment of the item ; depending on which situation comes first (recovery of the products or provision of proof of shipment).

Be careful, in the event of late refund, the sums due for refund may be increased depending on the number of days late.

For more information, we invite you to consult articles L.221-24 and L.242-4 of the French Consumer code.

NO. The return costs of the product under the right of withdrawal are the responsibility of the buyer. As a gesture of goodwill, you can take charge of the costs but it is not an obligation.

However, assuming that the product cannot be returned by post (for example bulky items), you are required to recover it at your expense. You will therefore have to advance the return costs or provide a full refund of these costs to the buyer.

For more information, we invite you to consult article L.221-23 of the French Consumer code.

Invoice

YES. In the case where a sale of goods is subject to VAT in France, the corresponding invoice issued by the professional seller has in principle to comply with French invoicing tax obligations, even if they are not established in France. Such invoicing obligations provide in particular that the invoice has to include several mandatory statements.

For more information, please consult :

- Article 289 of french General tax code ;

- https://entreprendre.service-public.fr/vosdroits/F23208 ;

- FAQ concerning the collect of VAT.

In particular, you should check whether the invoice you send to a France-located client has to comply or not with French invoicing tax obligations. By example, with respect to the sales made via Rakuten since July 1st, 2021 (without option OSS portal), you have to issue to the client an invoice complying with French rules in the case where (i) you are located in France or in the EU and (ii) you sell goods which are located in another EU Member State to a non-professionnal client in France.

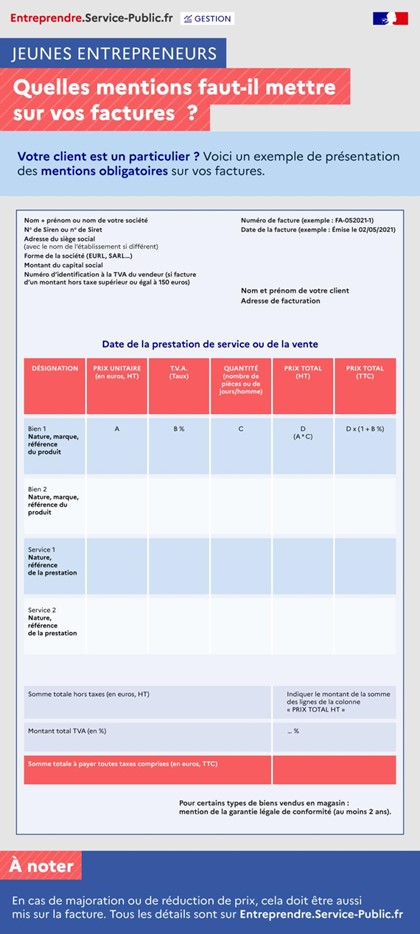

Invoices which shall comply with French invoicing rules, have to include several mandatory statements, including :

- invoice number and issuance date of invoice:

The number of the invoce does not correspond to the number of the order placed on the Platform. According to 7°th of the article 242 nonies A of annexe II of french General tax code, it is a unique number based on a chronological and continuous sequence.

The number of the invoce does not correspond to the number of the order placed on the Platform. According to 7°th of the article 242 nonies A of annexe II of french General tax code, it is a unique number based on a chronological and continuous sequence.

- statements on the parties :

- name or company name of the seller and of the client ;

- address (or registered office) of the seller and of the client ;

- VAT identification number of the seller and client (if professional) ;

- if a company, SIREN or SIRET number, mention of the legal form and the share capital (RCS number for a merchant).

- statements regarding the sale(s) :

- for each sale (if several) :

- date of the sale when different from the issuance date of invoice ;

- detailed number and description of each sold goods ;

- unite price exclusive of VAT ;

- discounts granted at the date of the sale and directly linked to this transaction ;

- applicable VAT rate or, if applicable, benefit of an exemption.

- general statements :

- total amount of VAT to be paid and, by tax rate, total excluding VAT and corresponding VAT ;

- if applicable: discounts not related to specific sale ;

- date on which payment must be made, discount conditions in case of early payment, penalties due in case of late payment.

For more information, please consult the following documentation :

- https://www.economie.gouv.fr/entreprises/factures-mentions-obligatoires ;

- https://www.economie.gouv.fr/cedef/facture-mentions-obligatoires ;

- https://entreprendre.service-public.fr/vosdroits/F31808 ;

- The following model:

|

Please note that:

We remind that, RAKUTEN’s contribution to the development of this Frequently Asked Questions (FAQ) is only a brief and non-exhaustive presentation of the legislation concerned. Therefore, this FAQ does not in any way constitute legal advice from RAKUTEN.

|

Requests for removal of illegal content

|

Please note that:

We remind that, RAKUTEN’s contribution to the development of this Frequently Asked Questions (FAQ) is only a brief and non-exhaustive presentation of the legislation concerned. Therefore, this FAQ does not in any way constitute legal advice from RAKUTEN.

|

I see content on the Platform that is illegal and/or infringes my rights, what should I do ?

After issuing a formal notice to the author or publisher of the content considered to be disputed within the European Union law or the law of a Member State (content violating intellectual property rights, terrorist content, etc.) it should be reported to RAKUTEN, following the conditions imposed by law no. 2004-575 of June 21, 2004 “pour la confiance dans l’économie numérique” also known as “LCEN”.

For more information, please consult the online help « Je souhaite signaler une erreur sur une fiche produit, signaler un contenu ou un comportement illicite ».

Dangerous products

Safety and compliance of the products you sell on the platform are crucial aspects for businesses operating in the European Union (EU), especially in the context of online commerce.

As a seller, you are and remain primarily responsible for ensuring that your activities comply with all national and European standards, laws, and regulations. Since February 17, 2024, we ask you to self-certify this commitment, as outlined in our commitment certificate. On December 13, 2024, certain obligations will expand and intensify with the implementation of the General Product Safety Regulation.

Regarding compliance in a broad sense, you are responsible for compliance in the following areas:

- Product packaging: in accordance with the EPR and specific provisions governing packaging.

- Your listing (including images and descriptions): in accordance with consumer law, including all pre-contractual information related to the product.

- Your store: your legal notices and any content you may upload to your store.

- The product itself.

Concerning product safety, new national and European standards have been introduced to strengthen the obligations imposed on both sellers and online marketplaces. Below, you will find the impacts this may have on your activity within our Platform.

Product safety in the EU is governed by a number of directives and regulations. Some product categories are regulated by sector; you can find them in the “Sectoral regulations” section below.

Firstly, REGULATION (EU) 2019/1020 of June 20, 2019 on market surveillance and product conformity, which came into force on July 16, 2021, requires all sellers of regulated products (subject to CE marking) to have a natural person or entity present in the EU, a contact point for consumers, authorities, and in charge of various obligations related to product safety.

Secondly, new regulations, such as that relating to batteries, but above all REGULATION (EU) 2023/988 of May 10, 2023 on general product safety, greatly extend all the obligations of the above-mentioned Market Surveillance Regulation to the vast majority of non-food products.

In addition to the obligations relating to CE marking and product conformity, we are required, as a marketplace, to provide you the possibility to display the information on the manufacturer and the responsible person in the EU. If you are subject to these obligations without having fulfilled them with Rakuten, your listing may be qualified as a “Prohibited Product” within the meaning of the General Terms of Use, and Rakuten reserves the right to take any measure to re-establish the conformity of your products and/or to put an end to any manifestly illicit activity that may cause a risk to the health and safety of Members.

In the strict sense of the Market Surveillance Regulation, the economic operator is “the manufacturer, authorized representative, importer, distributor, order fulfillment service provider or any other natural or legal person subject to obligations in connection with the manufacture of products, making them available on the market or putting them into service in accordance with the applicable harmonization legislation of the Union”.

Thus, the “responsible person” in the European Union (EU) is a key concept in the regulation of products marketed within the EU. This designation applies primarily in the context of certain product categories, such as cosmetics, toys, medical devices and chemicals, but the principle can be extended to other areas depending on the specific legislation applicable. See section

REGULATION (EU) 2023/988 of May 10, 2023 on general product safety extends these compliance obligations to a large number of non-food products. This Regulation adds to the information related to economic operator, the information related to the manufacturer, which will also have to be communicated or inserted within your ad as of December 13, 2024.

The responsible person is the entity (either a natural person or a legal entity) that assumes responsibility in the legal sense for a product’s compliance with all EU regulatory requirements before it is placed on the market. This means that the responsible person must ensure that the product is properly assessed in terms of safety, that all necessary documentation is available and up to date, and that the product complies with all applicable legal and regulatory requirements.

A product may not be placed on the market if the safety obligations specific to it have not been complied with, and as such, if no person responsible for compliance with these obligations can be identified in the European Union. Thus :

- For EU Manufacturers: If the manufacturer is based in the EU, it is generally considered to be the responsible person, but it may also appoint a representative.

- For Non-EU Manufacturers: If the manufacturer is based outside the EU, it must appoint a representative within the EU to act as the responsible person. This representative must be established in the EU and have the necessary skills and information to assume this responsibility. This is often the case for the importer.

Therefore, if you are established outside the EU, you must appoint a responsible person and inform us of this, and if you are established in the EU and have appointed a different legal person, we must also be informed of this. You remain responsible for the accuracy of the data you provide.

CE marking is compulsory only for products for which European specifications exist and which require CE marking, in particular those mentioned in the section below.

Some products may be subject to several requirements at the same time.

You must therefore ensure that your product complies with all relevant requirements before affixing the CE mark. It is forbidden to affix the CE mark to products for which there are no European specifications or which do not require CE marking.

As a manufacturer, please be careful to involve conformity assessment organisations (notified body) to assist you in the self-assessment process of your products. Then, please know that notified bodies are the only entities allowed to issue certificates of compliance for harmonized products and in the area for which they are notified.

Once all the formalities have been completed (which you can find on this site), and the CE mark affixed, if Rakuten or a competent national authority so requests, you must provide all the information and supporting documents concerning the CE mark and/or the conformity of the Product.

With the adoption of the Digital Services Act (DSA) and the Product Safety Regulation (RSGP), we must enable you to provide us with more and more information specifically targeted by these texts and allowing us to better inform the Consumer. Here’s how to comply with these regulations on Rakuten:

- Pre-contractual information: All photos linked to your ads must faithfully represent the product and, where applicable, enable buyers to access all essential information proving the product’s conformity. Make sure that your products are correctly marked (e.g. with the CE mark) and that the mandatory information is provided to consumers in a clear and comprehensible manner. For example, photos of your product should include a picture with the CE mark visible, or any other essential conformity element. The description of your ad must also include all the information relating to your product, as well as safety messages (age requirements, instructions for use, etc.). The latter must also be directly available on the packaging or within your parcel.

- Responsible person in the EU: As mentioned above, the appointment of a responsible person in the EU may sometimes be mandatory (especially if you are based outside the EU). Rakuten has defined a specific location within the product sheets in order to display certain elements related to the safety and compliance of the Products.

Therefore, in order to communicate the contact details of your economic operator within the EU to Consumers, please indicate this in the descriptions of your listings. Rakuten will soon provide you with a technical solution for importing this specific information in order to display it in a space dedicated to product conformity and safety.

- Documentation and Conformity Assessment: Make sure you have all the necessary documentation proving the conformity of your products, including declarations of conformity and test reports. Rakuten may carry out random or spot checks, either proactively or at the request of the relevant authorities.

In short, product compliance in the EU requires a proactive approach on your part, involving good knowledge of applicable regulations, rigorous documentation, and close cooperation with online sales platforms. We invite you to get in touch with your suppliers, service providers, accountants and any legal advisors to ensure that you comply as fully as possible with the applicable standards.

If one of your products sold on the Platform is subsequently identified, by you, your manufacturer, your economic operator, a market surveillance authority or any other natural or legal person with the capacity to identify products and recognize their dangerous or non-compliant nature, we invite you to contact the buyer(s) of the said product to inform them of its potential dangerousness, as well as of the measures put in place to return the product, obtain a refund, or if necessary, proceed with its destruction.

Naturally, we invite you to remove all offers of the above-mentioned products, which may pose a risk to buyers, as well as all similar and identical products with the same risks, as soon as possible.

Should Rakuten identify this type of product, Rakuten reserves the right to take all necessary measures to stop the risks inherent in this type of product.

Below you will find the European portal for dangerous non-food products:

You’ll find all regulated products on the European Commission’s dedicated website: https://single-market-economy.ec.europa.eu/single-market/ce-marking/manufacturers_en

The main products regulated by CE marking, which must comply with European Union safety, health and environmental protection standards, cover a wide range of categories. Here’s an overview of product categories typically subject to sector-specific regulations:

- Electrical and electronic equipment: This includes household appliances, computer equipment, lights and lighting, and any equipment powered by electricity.

- Toys: All toys intended for use by children.

- Machinery: This covers a wide range of industrial, agricultural and construction machinery.

- Medical devices: From basic medical equipment to implantable medical devices and in vitro diagnostics.

- Personal protective equipment: Such as helmets, protective gloves and safety glasses.

- Construction: Materials and components used in the construction of buildings and infrastructure.

- Measuring instruments: such as scales, thermometers and pressure gauges.

- Energy-related products: Including boilers, heating and cooling equipment, and products with an impact on energy consumption.

- Pressure equipment: This includes boilers, pressure storage tanks and pressure piping, intended for use at pressures above atmospheric.

- Chemicals: Certain hazardous chemicals, biocides, and substances subject to REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations.

- Telecommunications and radio equipment: This refers to devices that transmit and receive radio signals, including cell phones, Wi-Fi equipment and radios.

- Gas appliances: Gas-powered heaters, stoves and barbecues are included in this category.

- Motor vehicles and their components: This covers vehicles and their parts, including safety systems such as airbags and seatbelts.

- Aerospace: Equipment and components used in the construction and maintenance of aircraft.

- Marine equipment: Equipment used on board ships, including life-saving and navigation devices.

- Pyrotechnics: Fireworks, flares and other articles containing explosive substances.

- Equipment for use in potentially explosive atmospheres (ATEX): Electrical and non-electrical equipment intended for use in potentially explosive environments.

- Sports equipment: In addition to children’s toys, certain equipment

VAT Collection

European VAT regulation evolves, and so do French regulations applying to internet sales to French customers (BtoC). From July, 1st 2021, Rakuten will collect VAT and retain VAT amount on behalf of some sellers’ accounts.

You will find below the elements to remember concerning this evolution.

If you wish to be contacted by your E-Commerce Consultant concerning the new VAT regulation in force, click here.

You are NOT affected by this reform if you are a seller estabished in the European Union and shipping his goods from the EU only.

From July, 1st 2021, we will pay VAT on your behalf if you are:

- A seller established outside of European Union (no matter if the goods are already in an EU warehouse)

- A seller shipping his goods from a non-EU country, no matter where you are established.

- We will collect VAT instead of the sellers mentioned above

We will then deduce it from the amounts we will distribute to them (at the same time and in the same way as the commission). In order for us to calculate VAT, you will have to indicate the usual shipping location of your parcels in your seller’s preferences and reconfirm it for each order.

- Suppression of €22 threshold for imports: VAT will be applied from the 1st euro

No parcel will pass customs without information on who will pay VAT on it. You need to clearly show on the parcel and on customs documents the VAT number we will give you to allow customs clearance.

- For the parcels which come from a country outside of European Union: a customs declaration will still be necessary

A reconciliation of figures will be done between customs and VAT declarations so there must be no difference of values between customs declarations (made by the seller) and VAT declarations (made by Rakuten).

| Parcel < 150 €* | Parcel > 150 €* | |

| VAT | We will give you a special VAT-IOSS number which must be shown on the parcel and on customs declarations. | We will give you another VAT number to be shown on the parcel and on customs declarations by the seller. |

| Customs declaration | A special simplified custom online declaration, called Delta H7 must be filled by the seller. Parcels below €150 will still be exempt from customs duties. |

You must fill a full declaration and pay the respective customs duties. |

*Parcel value excluding shipping costs

In accordance to new VAT rules in force since July 1st 2021, electronic marketplaces like Rakuten are directly liable for VAT with respect to certain types of sales made through them.

Since this date, there have also been several other important changes:

- the previous VAT exemption for imported goods which value do not exceed EUR 22 is no longer available;

- the VAT regime of intra-EU distance sales of goods has been harmonized within the EU and provides with the taxation in the customer’s Member State above an overall turnover threshold of EUR 10.000 (assessed at the level of all Member States);

- implementation of a new VAT regime applying to distance sale of goods which value do not exceed EUR 150 and which are imported from outside the EU directly to EU customers.

The reporting and payment obligations regarding the VAT regime of intra-EU distance sales of goods and the regime of distance sales of imported goods may be fulfilled, on an optional basis, with new electronic portals (“OSS” and “IOSS” portals).

For this purpose, Rakuten, which is registered at the IOSS portal, provides sellers with its IOSS number in the cases where Rakuten is liable for VAT according to the new VAT regime applying to distance sale of imported goods, in order to avoid that VAT would be charged upon the importation of goods into EU.

A taxable person for VAT purposes is a person who independently carries out economic activities on a regular basis:

- carrying out an economic activity on a regular basis: all activities of producers, merchants, or service providers (including liberal, agricultural, civil, or extractive activities) that are not carried out on an occasional basis.

- independently: the person must not be placed in a subordinate position and must carry out the economic activity under his or her own responsibility (for example, an employee cannot be a taxable person for VAT purposes).

A VAT person who sells goods in the frame of its economic activities is subject to VAT: it has to collect VAT from its clients (i.e. VAT is added to the sale price paid by the clients) and to pay it to French Treasury.

For example, in the case where your activities would be to purchase mobile phones from suppliers and to re-sell them daily to customers, it is likely that you should qualify as a VAT person. In the case where you are an individual who exceptionally sells an old dishwasher, you should not qualify as a VAT person with respect to this sale.

- Assessment of the State in which you are established:

By principle, the State in which you are established is the State where you have established your business. The place where your business is established results from several concrete elements (eg. place of the registered office, place of directors’ meetings, place where financial activites are carried out. In case there would be a discordance between different elements, the place where your business is established will correspond to the place where are taken the key decisions regarding the management of the business. For exemple, a sole mailbox in France should not lead to consider that the business is established in France.

By exception, for a given transaction, you could be seen as established in a different State from the State where your business is established in the case where :

- you have in this other State a permanent establishment which has a sufficient degree of permanence and a structure able, from a human and material resources point of view, to carry-out a services activity; and

- this transaction is carried-out from this permanent establishment.

- Impact of the place where is established:

By principle and subject to specific situaitons, the place where your business is established is not taken into account in order to assess whether a supply of goods is subject or not to VAT in France. For example, you would be liable for VAT in France in the case where you sell goods located in France to French clients, regardless the place where your business is established.

By exception, the place where your business is established is taken into account for the sales made via Rakuten. With respect to the domestic sales and the intra-EU disance sales made via Rakuten:

- in the case where you are established in France or in the EU, you will be liable for VAT and will have to collect VAT on such sales;

- in the case where you are established outside the EU, Rakuen will be liable for VAT and will have to collect VAT on such sales.

The place where your business is established will also have consequences on filing obligations and VAT deduction / reimbursement (i.e. filing obligations, procedures and deduction mechanism could differ depending on whether your business is established in France, in the EU or outside the EU).

- You have a VAT number in France : are you considered to be established in France?

By principle, the mere fact that you have a VAT number issued by a Member State should not have any consequence on the determination of the place where your business is established.

By exception, French tax authorities should consider that you should be deemed to be established in France with respect to sales made in France in the case where:

- you have a permanent establishment in France which has a VAT number; and

- you report such VAT number on the invoices provided to French clients.

Such presumption could be reversed if it is evidenced that your permanent establishement did not take part to such sales (i.e. such sales were made from the place outside France where your business is established or where you have another permanent establishment).

- You are established in a French overseas territory: what is your place of establishement for the purposes of the new VAT rules in force since July 1st, 2021?

In the case where you are established in a French overseas territory (Guadeloupe, Martinique, La Réunion, Guyane et Mayotte), you are considered as established outside the EU with respect to the new VAT rules which are in force since July 1st, 2021.

Since July 1st 2021, as a professionnal seller, you are still liable for VAT with respect to the sales of goods to non-professionnal customers made via Rakuten in the following cases:

- in the case where you are established in France or in the EU, you are liable for VAT regarding intra-EU distance sales of goods and domestic sales of goods to customers in the EU;

- regardless the place where you are established, regarding goods which value is exceeding EUR 150 and which are imported from outside the EU into another EU Member State and then delivered to a customer in France, you are liable in France for VAT on the delivery of the goods to the customer;

- depending on local rules in each Member State, regarding goods which value exceeds EUR 150 which are imported from outside the EU to France or another EU Member State and then delivered in another EU Member State, you could be liable for VAT in the other States Members;

- regardless the place where you are established, depending on local rules in each Member State and on specific customs schemes, you may be liable for importation VAT in the case where you import goods from outside the UE into a warehouse located in the UE prior to any sale.

To be able to assess whether one of the situation above is applicable, Rakuten has to collect specific information from the sellers [renvoi à la question / réponse sur les informations à communiquer à Rakuten ou renvoi à la question / réponse « You are a professional seller outside EU and you sell goods located outside EU whose value does not exceed EUR 150 to a French client via Rakuten »].