Cashback: What it is, How it works and Why it matters

To the question "How can we fight inflation?", one of the solutions can be summed up in one word: cashback. At a time when shoppers are constantly on the lookout for good deals to compensate for their loss of purchasing power, cashback offers are an ideal lever. And that's not all!

Cashback is a win-win strategy. Like consumers, sellers benefit from the many positive spin-offs this model can bring. But do you (really) know what cashback is? How does it work? And how can you effortlessly set up a cashback offer for your customers?

This guide has you covered!

Definition: what is cashback?

Cashback is a form of reward that forms part of a loyalty program strategy, offering customers the chance to earn loyalty points with every purchase they make. These rewards can be credits, points or directly in cash. Buyers can then use them for future purchases on the platform. 48% of French consumers report using at least one cashback program¹.

Most often, this partial reimbursement model is between 0.5% and 20% of the amount spent. A great reward for shoppers. With INSEE forecasting a 2.2% rise in consumer prices in one year (June 2024), cashback offers a way for consumers to mitigate the effects of inflation.

While cashback programs exist in physical stores, they are primarily prevalent online. Cashback is common on e-commerce sites, marketplaces, and specialized platforms affiliated with partner sites. With every purchase, online shoppers save money. Not to be confused with promotions!

What's the difference between cashback and promotions?

In online shopping, cashback is often confused with promotions. However, the two strategies differ significantly:

- Promotions are fixed before a purchase. Discounts are set by merchants during sales, Black Friday, or at other times of the year. The price of the product is therefore altered, for example by using coupons or promo codes.

- Cashback is a refund offered after the purchase. It doesn't change the product price; the customer pays the listed price but receives a reward later.

In essence, cashback is a delayed reward, while promotional codes offer instant savings.

However, you don't have to choose between these two forms of reward. They are complementary. For example, on our Rakuten marketplace, shoppers who are part of our loyalty program (Club R) can earn both:

- An immediate discount in the form of a promotional code, on their first order.

- Cashback credited to their customer account, up to 20% refunded on every purchase.

A great way to save money.

How does cashback work?

71% of French consumers report understanding how online cashback works². Are you one of them?

Cashback functions similarly to a promotional offer: the seller sets a percentage to be rewarded on each purchase of their products. Companies can implement the system themselves or partner with a cashback network.

For consumers, it's just as simple:

- The customer is a member of the company's loyalty program.

- They make a purchase, typically online (though some physical stores also offer cashback). On Rakuten, cashback works on new or second-hand purchases.

- After the purchase, the customer recovers a percentage of the total amount spent.

- This amount is added to the customer's kitty, or in the form of points (which can sometimes be accumulated).

- Customers can then use their cashback to finance future purchases!

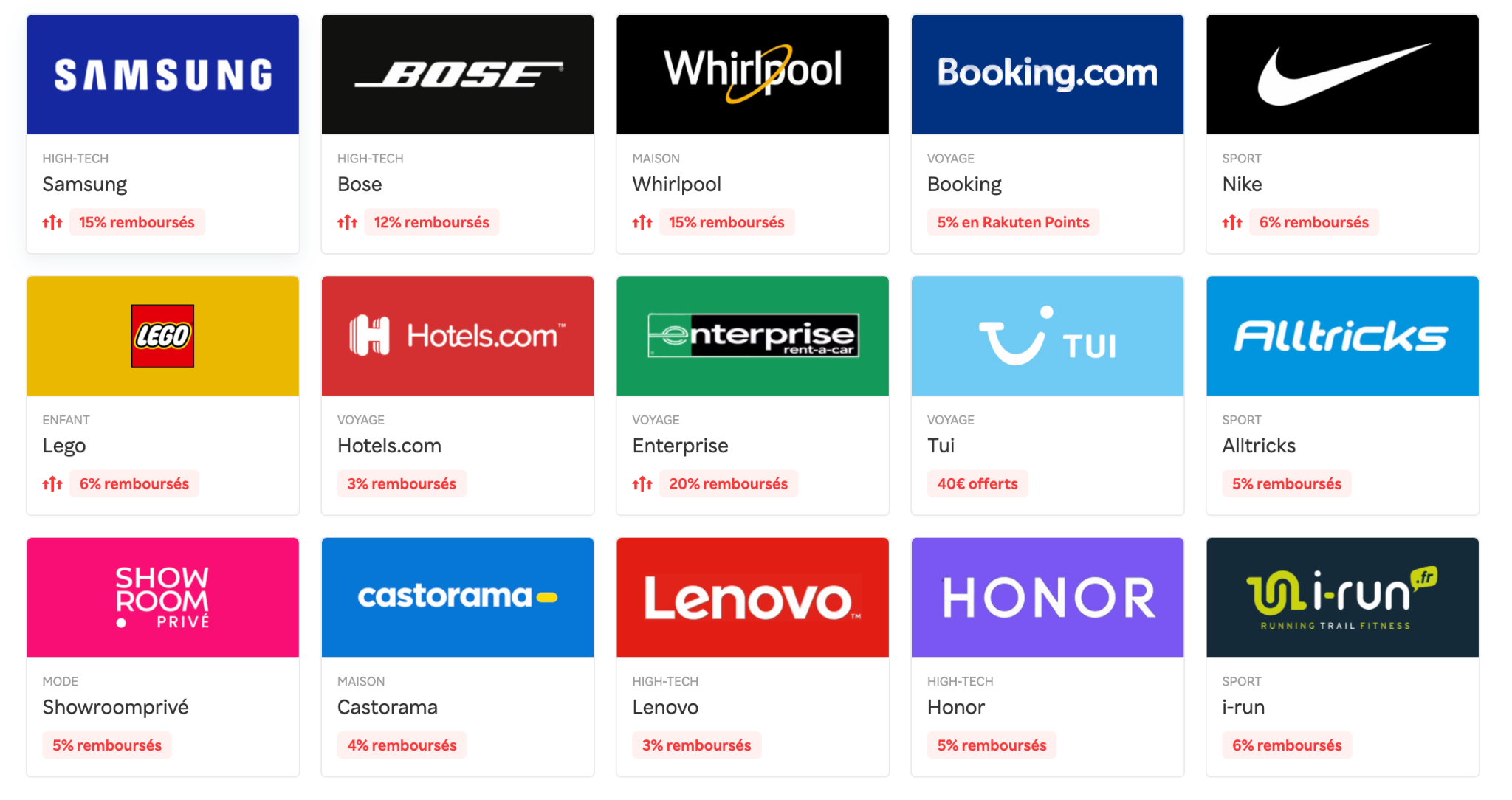

Example: Here are a few examples of possible cashback on Rakuten partner sites:

Cashback: what are the benefits for customers?

This form of reward offers many exclusive advantages to buyers. Here are just a few of them:

- Saving money : by recovering part of the amount spent, customers reduce the actual cost of their orders. For regular or high spenders, this is an excellent way to benefit from savings.

- Flexible use of rewards: depending on the site, cashback is paid in the form of credits, loyalty points or euros. Internet users are free to choose how they receive cashback on their purchases.

- Flexibility in obtaining rewards: conversely (and upstream), on some sites like Rakuten, it's possible to accumulate cashback from over 2,000 partner sites! The cashback can then be spent on Rakuten.

- Easy to use: a cashback offer can be activated in just a few clicks. It couldn't be simpler. Forget the days of collectable coupons and hard-to-remember promotional codes! Browser extensions like Rakuten's Club R can also automate cashback from partner sites.

- More thoughtful spending : with cashback, users can compare offers between different merchants before finalizing their purchases. Consumers take their time to think things through, and avoid compulsive shopping.

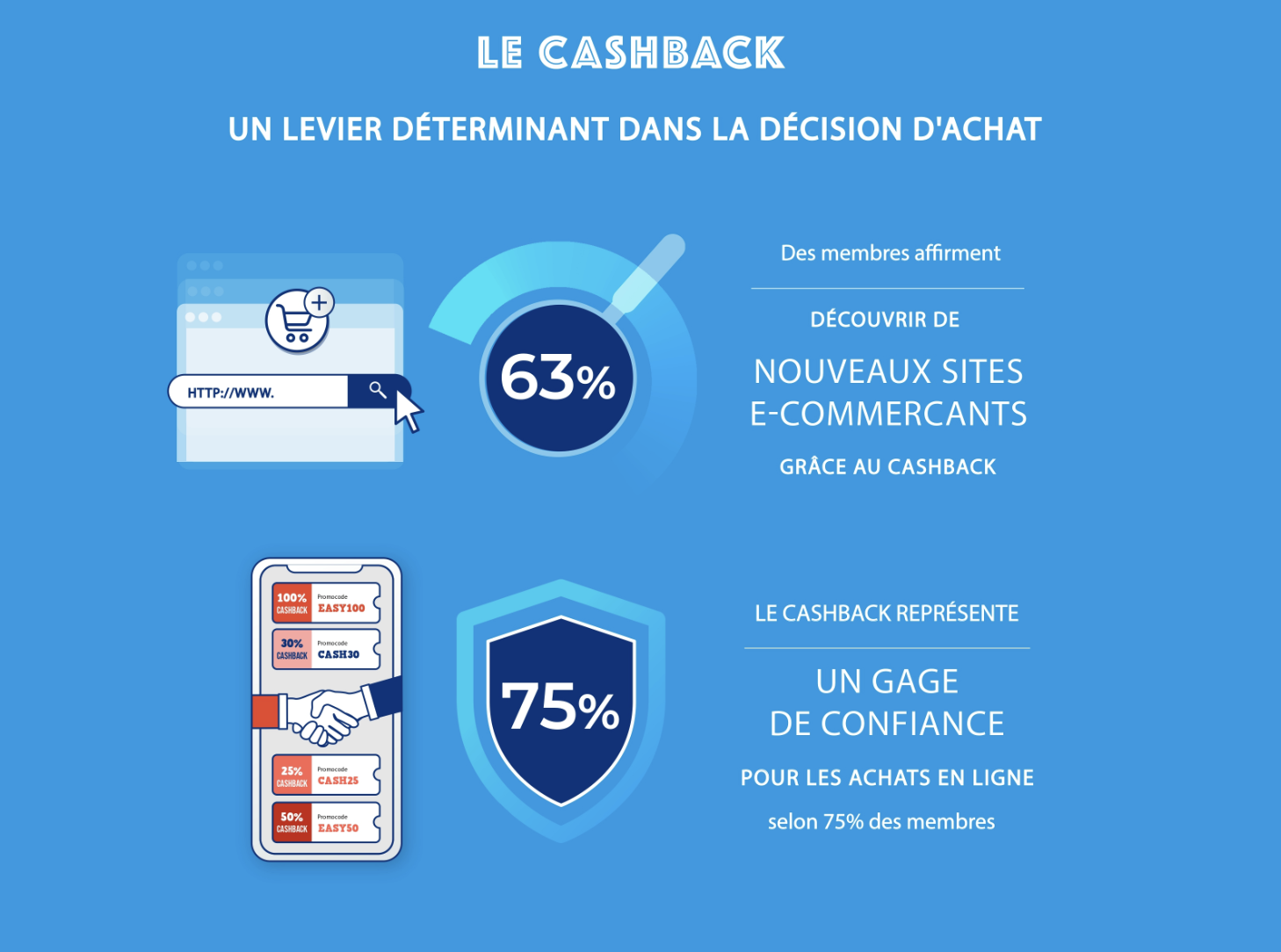

- Discovery of new sites: 63% of customers are happy to discover new E-Commerce sites thanks to cashback (source: Syndicat National du Marketing à la Performance (SNMP) study)

- Increased confidence: with a cashback offer, buyers gain confidence in the website they are visiting. For 75% of those surveyed, cashback is a sign of confidence when shopping online! (source: study by the Syndicat National du Marketing à la Performance (SNMP))

Source: extract from theSNMP infographic

Cashback: what are the benefits for retailers?

Cashback is also a virtuous circle for merchants. The benefits are as follows:

- Attracting new customers: as we've just seen, 63% of consumers discover new sellers thanks to cashback. What's more, 42% of French people consider cashback to be a decisive factor in choosing an e-retailer (Ipsos 2024 study). By offering cashback, you can win new customers who are sensitive to bargains. It's easier to capture consumers' attention and encourage them to make a purchase.

- Retain existing customers: 71% of e-tailers consider cashback to be an effective tool for acquiring and retaining customers. Rewards keep customers coming back for future orders. Bingo, it's an excellent lever for customer loyalty and retention!

- Improved brand awareness: by relaying cashback offers on platforms or via marketing campaigns, the company attracts attention... And increases its brand awareness and visibility. Perfect for reinforcing brand image in the face of other market players.

- Competitive advantage: when it comes to market players, kitty marketing is an effective strategy for standing out from the crowd. Competitors who don't offer this type of reward are instantly less attractive!

- Increase in average shopping basket and frequency of purchase: e-retailers who have implemented cashback report a 10-20% increase in their average shopping basket, and a 2-fold increase in frequency of purchase (source: study by the Syndicat National du Marketing à la Performance (SNMP)).

- Increased conversion rate: this increase is around 5% with cashback. A significant lever for growth! (source: study by Syndicat National du Marketing à la Performance (SNMP))

For relevant advice on how to improve your strategy, read our article Marketplace: A practical guide to boosting your E-Commerce.

Source: extract from theSNMP infographic

Example of a cashback program: Rakuten's Club R

At Rakuten, we've made cashback one of our top priorities. To enable consumers to save, and sellers to acquire and build loyalty.

Our cashback program is called "Club R":

- 13 million members

- 900 € purchasing power on average

- 40% higher average shopping basket than non-members

Through this free, no-obligation loyalty program, members receive up to 20% cashback on every purchase... whether on products bought from the Rakuten marketplace or from the network of 2,000 affiliated partners (including Booking.com, Nike, Lego, Apple...)

The kitty is financed by Rakuten, and takes the form of Rakuten Points. According to Fevad (2021), we are the most generous E-Commerce program in France!

So, are you convinced by this win-win system for both your brand and your customers? Now all you have to do is implement it.

How to deploy a cashback strategy easily with Rakuten?

Would you like to invest in cashback, but don't know where to start? Follow the guide:

1. Join the Rakuten marketplace

Start by creating your Rakuten account by filling out this form.

After registering, simply complete these 4 steps to start selling on our platform:

- Activate and configure your Rakuten E-Shop using the code sent to you in your confirmation e-mail.

- Import your products onto the platform.

- Customize your shipping costs.

- Activate payment for your sales.

Your ads will then be eligible for the 5% cashback financed by Rakuten. The only exception? Products covered by the Lang law of August 10, 1981, which imposes a single price on new books in order to protect the industry.

2. Create additional cashback campaigns

By becoming a Rakuten seller, you can manage your own development strategies. You can offer up to 20% extra cashback in the form of Rakuten Points, available only on your offers. So what are you waiting for to boost your sales?

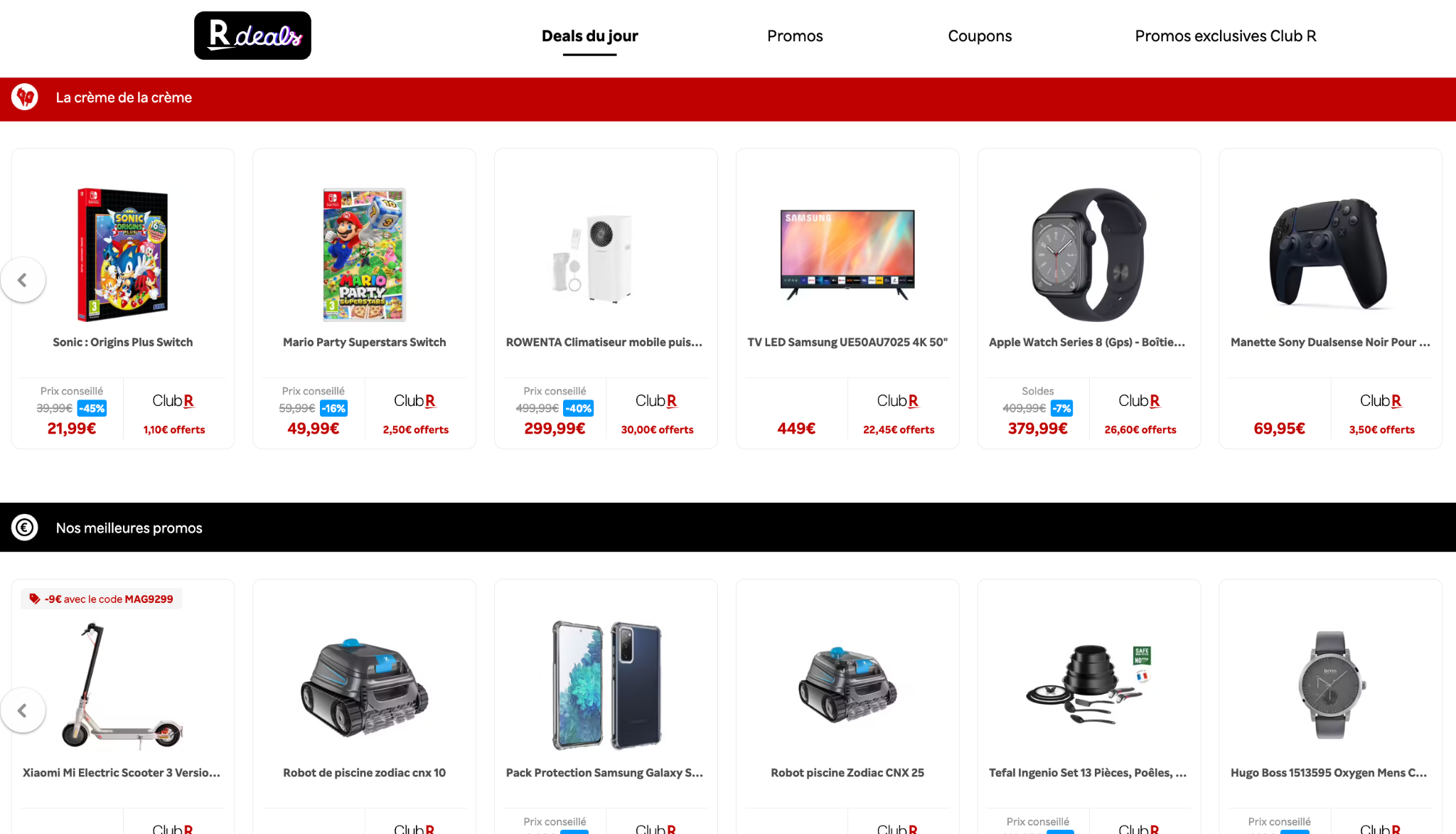

By activating additional cashback campaigns, you can offer your customers additional discounts without changing the face price of your products. Ads with additional cashback in Rakuten Points are automatically promoted on the most attractive sites on our platform. Here's an example of the high-traffic Rakuten Deals page.

This additional cashback service works on a performance basis. You only spend what you generate. An economical choice for you, and one that your customers appreciate. In fact, shoppers are more likely to opt for offers that multiply the points they earn in their kitty.

Imagine: you offer a 10% discount in points on a day when Rakuten is offering 20%. Your customers (Club R members) benefit from a double advantage and 30% cashback ! The results? They take action without hesitation.

3. Calculate your budget

Before rushing into thecashback exercise, don't forget to calculate your budget.

Let's go back to the previous example. On a Rakuten Day, when Rakuten finances 20% of the platform, you offer an additional 10% commission in points.

A Club R member selecting a €200 product in your store will receive :

- 10% x 200 = €20 thanks to your Rakuten Points campaign

- 20% x 200 = €40 thanks to Rakuten Points financed by Rakuten

Your customer will receive a total discount of €60!

To define your budget, you need to calculate a percentage of business volume that will be generated over a set period. For example, if you set up a 10% points campaign on a selection of products, you need to calculate the volume you'll generate and apply 10% to it.

It's up to you to define this discount percentage, according to your budget. You can also adjust it at any time. And if in doubt, ask your E-Commerce Consultant for advice: he'll help you define the best budget and strategy to boost your growth.

4. Analyze the performance of cashback campaigns

A cashback strategy doesn't stop when it's deployed. Keep track of the results over time!

In fact, your ads benefiting from additional Rakuten Points are automatically highlighted on the most attractive sites on the Rakuten platform, including the Rakuten Deals page. These ads are also promoted on product sheets, on your e-shop and on our various acquisition levers.

Your mission (if you accept it) is to monitor the performance of these campaigns, on the different sites. Analysis can be done in real time. From your Rakuten seller space, you have everything you need to manage your budgets, identify the most effective exclusive offers and optimize your ads.

On your marks, get set... Launch cashback, analyze, optimize, then do it again.

To win new customers with cashback, build loyalty with existing ones and increase your average shopping baskets, discover Rakuten cashback! Our 13 million Club R members are waiting for you. And what about you? What are you waiting for to take advantage of Rakuten's special offers and exclusive cashback operations?

Sources:

¹ Ipsos x Rakuten, Cashback study 2024

² Webloyalty and Kantar

³