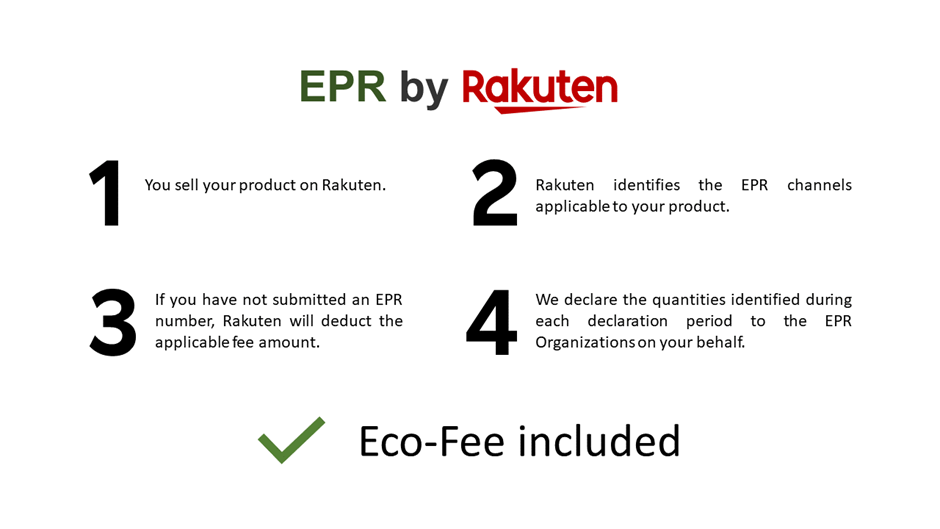

EPR by Rakuten

Eco participation included in your sales

EPR by RAKUTEN is the default mechanism for deducting the eco-contribution from each of your sales on the Platform on the “we declare for you” principle. Thus, if you sell Products on our Platform that fall within the scope of an EPR channel, without having previously communicated a valid IDU to us for whatever reason, RAKUTEN will directly deduct the amount of the eco-contribution and pay it to the eco-organizations on your behalf, within the limits of the thresholds defined by the latter. EPR by RAKUTEN also covers the 1-for-1 take-back of products covered by such take-back.

You will find the answers to your questions below on this page. If you cannot find an answer to one of your questions, please do not hesitate to contact us. In general, to find out more about EPR obligations, please consult our dedicated page. Other resources are available in French from the following links:

You will find the answers to your questions below on this page. If you cannot find an answer to one of your questions, please do not hesitate to contact us. In general, to find out more about EPR obligations, please consult our dedicated page. Other resources are available in French from the following links:

This help section describes the mechanism put in place by Rakuten to fulfill its regulatory obligations in accordance with article L541-10-9 of the French Environment Code. It in no way exempts professional sellers from all their legal EPR obligations, which are not limited to membership of eco-organizations and payment of the eco-contribution. Nor does it constitute an exhaustive, detailed summary of the regulations in force, or any form of legal advice on the part of Rakuten. In principle, each seller remains responsible for ensuring that his or her activity complies with current laws and regulations, and for taking the necessary steps on his or her own initiative. This includes providing the unique identifier.

The Extended Producer Responsibility (“EPR”) system is based on the “polluter pays”

principle. EPR aims to make the manufacturer, seller or importer responsible for the various

stages in the life of a product, from its creation to its reuse or recycling.

More generally, these provisions aim to finance all collection points, sorting, recycling and

reuse of all products covered by the law.

For information: EPR mainly takes the form of a contribution corresponding to part of the cost

price of your Product, intended to finance the prevention and management of the waste it

generates.

The products you sell are likely to be subject to EPR.

Indeed, if you sell under your own brand, or import or manufacture Products that fall within one of the many channels established by the AGEC law, as well as their packaging, you become subject to EPR and must contribute to the management of waste from your Products.

As a retailer, you are also subject to certain obligations, such as communicating the Producer’s IDU, and passing on the amount of the eco-contribution on each of your sales

without rebate.

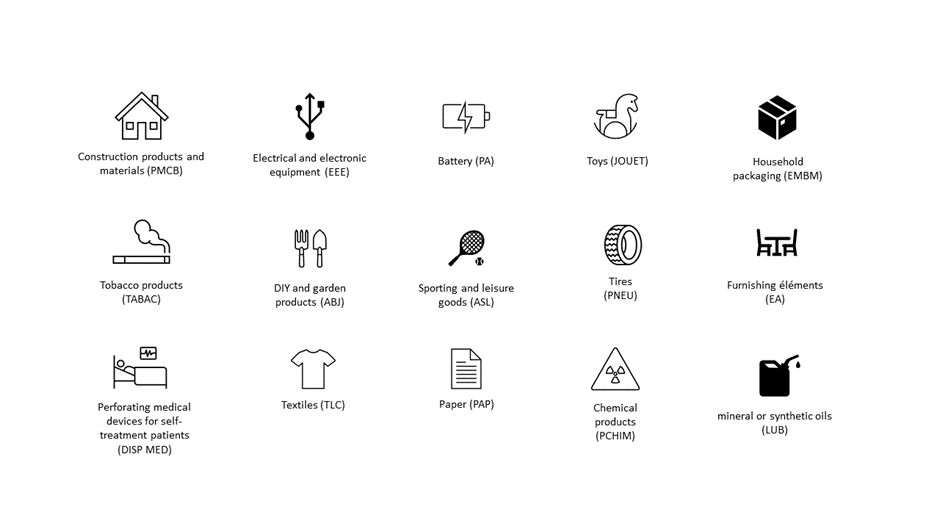

In accordance with Article L541-10-1 of the French Environment Code, the main channels are as follows:

If you sell products through these channels, you are affected !

The law provides two options for compliance:

- Setting up an approved individual collection and treatment system, or ;

- Managing your obligations by becoming a member of the eco-organizations approved for each sector in which you are involved, and paying a financial contribution (Eco-participation) in return for fulfilling your obligations.

You need to join the eco-organizations for each sector in which you sell your products:

| Industry | Category | Membership |

| Household electrical and electronic equipment industry (EEE) | EEE | ECOLOGIC |

| EEE, lamps | ECOSYSTEM | |

| Solar pannels | SOREN | |

| Packaging industry (EMBM) | EMBM | CITEO |

| EMBM | LEKO | |

| Batteries industry (PA) | PA | SCRELEC |

| PA | COREPILE | |

| Textile industry (TLC) | TLC | REFASHION |

| Toy industry (JOUET) | JOUET | ECOMAISON |

| Furniture industry (EA) | EA | VALDELIA |

| EA | ECOMAISON | |

| Sporting goods and leisure industry (ASL) | ASL | ECOLOGIC |

| Tire industry (PNEU) | PNEU | FRP |

| PNEU | ALIAPUR | |

| Chemical products industry (PCHIM) | categories 3 to 10 | ECODDS |

| Small fire extinguishers | ECOSYSTEM | |

| Pyrotechnic products | PYREO | |

| Oils and lubricants industry (LUB) | LUB | CYCLEVIA |

| Papers industry (PAP) | PAP | CITEO |

| Perforating medical devices for self-treatment patients industry (DISP MED) | DISP MED | DASTRI |

| DIY and gardening industry (ABJ) | category 2° – Thermal motorized machines and appliances |

ECOLOGIC |

| categories 3° – DIY equipment and 4° Products and equipment for garden maintenance and landscaping |

ECOMAISON | |

| category 1° – Painter’s tools | ECODDS | |

| Construction products and materials industry (PMCB) | Categories 1 and 2 | VALOBAT |

| Category 1 (Mineral products and materials) |

ECOMINERO | |

| Category 2 (Non-mineral products and materials) |

VALDELIA | |

| Category 2 (Non-mineral products and materials |

ECOMAISON | |

| Tobacco products industry (TABAC) | TABAC | ALCOME |

IMPORTANT: As soon as you have joined and registered with SYDEREP, we invite you to upload your IDUs from your seller profile.

In collaboration with the eco-organizations, RAKUTEN has identified the Products in its catalog that fall under the various channels currently in force in France, as well as the amount of the associated simplified eco-contribution. As soon as you make your first sale of a Product subject to EPR on the Platform, RAKUTEN will identify the channels corresponding to this Product, check whether or not there is an IDU associated with your profile, and if not, automatically deduct the amount of the eco-contribution.

In this context, it is important to note that you are and remain solely responsible for the correct categorization of your Products on the Platform, and RAKUTEN will not be able to reimburse you for amounts deducted from Products not subject to EPR that you have incorrectly categorized. On the other hand, if you believe, after agreement with the eco-organizations, that your correctly categorized Product is not subject to EPR, you can inform our teams, who will study your particular case (I DISAGREE WITH THE CATEGORIZATION OF MY PRODUCTS, WHAT SHOULD I DO?).

RAKUTEN will then declare the quantities of Products sold to the eco-organizations and pay the eco-contributions on your behalf. Information on the amounts deducted can be accessed directly from your seller preferences.

In the future, Rakuten will provide you with the amounts of the levies within your accounting export accessible from your seller preferences, so that you can see which of your Products have been declared in your place, so that you do not do so and pay the eco-contribution twice.

If this is the case, we invite you to rectify your declarations to the eco-organizations, in order to withdraw the products concerned.

If you have any doubts, please contact our teams for further details.

Today, the list of channels supported by Rakuten and the trigger dates are shown in the “REP by RAKUTEN” scale. You’ll find the channels, the amounts and the declaration periods.

Products declared by Rakuten no longer have to be declared to eco-organizations, and you don’t have to pay the eco-contribution for them either.

Please note: This does not, however, relieve you of :

- Your EPR obligation for Products that Rakuten has not identified as belonging to one or other of the channels in force.

- Your EPR obligation for Products sold outside of Rakuten, on other websites, Marketplaces, or in your physical stores.

- Your other EPR obligations, including, but not limited to, the implementation of a Prevention and Eco-design Plan.

If you no longer wish to be levied on your products subject to EPR under French law, you have several options:

- Transmit your own IDUs: By fulfilling your regulatory obligations as a manufacturer, importer or seller under your own brand and adhering to the eco-organizations concerning the Products you offer for sale. All you then have to do is send Rakuten your identifiers as soon as possible, for each channel in which you sell your Products. To do this, go directly to your seller area and enter your IDs.

- Provide us with your suppliers’ IDUs: as a reseller, you must provide us with your main supplier’s IDU for each of the channels in which you sell.

- Remove from your catalog products subject to EPR on Rakuten. Eco-contribution amounts collected in the past are not refundable.

If you sell products which, by exception, are not subject to EPR, please consult the section: “My products have been wrongly collected, what should I do?

To find out more about obtaining an IDU and complying with the AGEC law, consult the section “I want to be compliant, what do I do?” or our dedicated help page.

The names of the eco-organizations to which Rakuten adheres and declares on your behalf, the declaration periods, and the amounts deducted per unit of sale to consumers can be accessed directly from the “EPR by RAKUTEN” scale.

Amounts are calculated by multiplying the number of your new Products sold in France, for which Rakuten has been able to associate an EPR Product category with its rate on the simplified scale of each eco-organization and for each Product channel and family.

ATTENTION: By exception, and specifically for the packaging channel, your Products sold second-hand or reconditioned are also concerned, in that their primary and secondary packaging are considered new on principle. You therefore become subject to this channel, unless your packaging is exempt according to the strict criteria defined by law and the eco-organization (see: My Products have been wrongly collected, what should I do?).

Please note: Rakuten uses simplified Product categories and declaration scales, which means higher fees than if you join and contribute on your own or with the help of a facilitator. The use of these simplified scales does not entitle you to any eco-modulation.

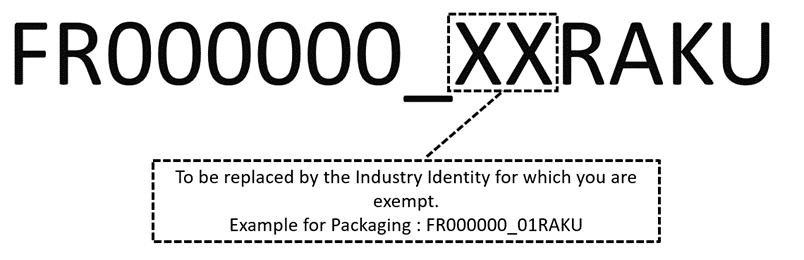

If you sell Products identified as being subject to EPR, but you are in fact neither a Producer nor a Reseller, you must indicate the following IDU to Rakuten in the fields of the channels for which you are exempt from said obligations:

Channel identities in accordance with article L541-10-1 of the environment code:

Channel identities in accordance with article L541-10-1 of the environment code:

| Chain | Identity | Chain | Identity |

| Electrical and electronic equipment (EEE) | 05 | Toys (TOY) | 12 |

| Batteries and accumulators (PA) | 06 | Mineral or synthetic lubricating or industrial oils (LUB) | 17 |

| DIY and gardening articles (ABJ) | 14 | Tyres (PNEU) | 16 |

| Household packaging (EMBM) | 01 | Chemical products (PCHIM) | 07 |

| Graphic papers (PAP) | 03 | Tobacco products (TABAC) | 19 |

| Clothing, household linen and footwear (TLC) | 11 | Perforating medical devices from self-treatment patients (DISP_MED) | 09 |

| Sporting and leisure goods (ASL) | 13 | Furnishings (EA) | 10 |

| Building sector products and materials (PMCB) | 04 | ||

| On January 1, 2024 | |||

| Chewing gum (GM) | 20 | Disposable sanitary textiles (TSUU) | 21 |

| On January 1, 2025 | |||

| Fishing gear (EP) | 22 | ||

ATTENTION: Entering this identifier means that your Products are exempt from EPR because they come entirely from re-use or meet the various conditions set by law and specified by the eco-organizations. Rakuten may conduct random audits and ask you for proof and justification.

If the levy is due to a wrong categorization of your Products, and not to their being reused, see the section below:

If you consider that your products are not subject to any channel, please follow the steps below:

- Check that you have correctly categorized your Product on our Platform, and in particular the information specific to certain channels (presence of a battery, thermal energy, electric, gas, wireless product, etc.).

- Check with the Eco-Organizations to make sure that your Products are not part of any EPR system.

- Contact our teams, indicating the products for which you are contesting the eco-contribution deduction.

- If your request is confirmed, we will proceed to regularize your situation for the past and the future, so that you can continue to sell with peace of mind.

Exceptionally, depending on cancellations, reporting periods, Product brackets and thresholds and eligibility for the simplified scale, recategorization of your Products and regulatory changes related to eco-organizations and EPR, Rakuten may be required to make adjustments to your sales in the event of overpayments or underpayments.

In addition, all your sales prior to the implementation of this mechanism (see the launch date for each sector in the Price List) will be billed retroactively in accordance with our Pro Price List.

Where applicable, you will be informed of this, together with all sales relating to these adjustments and the associated amounts.

In accordance with article 6. 4 of the Special Terms and Conditions for Professional Sellers, Rakuten reserves the right to re-invoice all amounts it may be required to pay as a result of a Professional Seller’s failure to comply with these regulations (including, including, but not limited to, any failure to pay the eco-participation fee, or any costs arising from a Buyer’s request to take back a used Product that have not been paid for by the Professional Seller). The supply of a fraudulent or non-compliant IDU may also give rise to such a chargeback.

If, for any reason, you sell Products on our Platform in categories subject to the 1 for 1 Trade-in system without having previously informed us of your Trade-in solution, RAKUTEN will handle the Trade-in for you within the limits of the categories managed by Rakuten’s partners.

Categories handled by Rakuten in the event that the seller fails to provide a take-back solution:

- Furniture over 20 KG.

In this case, Rakuten is obliged to pay the costs of the trade-in on your behalf. In this case, as indicated in the Pro Special Conditions, Rakuten will re-invoice you in full for the amounts paid on your behalf in accordance with the conditions set out in the Pro Price List. Service charges may also apply.