Invoice

YES. In the case where a sale of goods is subject to VAT in France, the corresponding invoice issued by the professional seller has in principle to comply with French invoicing tax obligations, even if they are not established in France. Such invoicing obligations provide in particular that the invoice has to include several mandatory statements.

For more information, please consult :

- Article 289 of french General tax code ;

- https://entreprendre.service-public.fr/vosdroits/F23208 ;

- FAQ concerning the collect of VAT.

In particular, you should check whether the invoice you send to a France-located client has to comply or not with French invoicing tax obligations. By example, with respect to the sales made via Rakuten since July 1st, 2021 (without option OSS portal), you have to issue to the client an invoice complying with French rules in the case where (i) you are located in France or in the EU and (ii) you sell goods which are located in another EU Member State to a non-professionnal client in France.

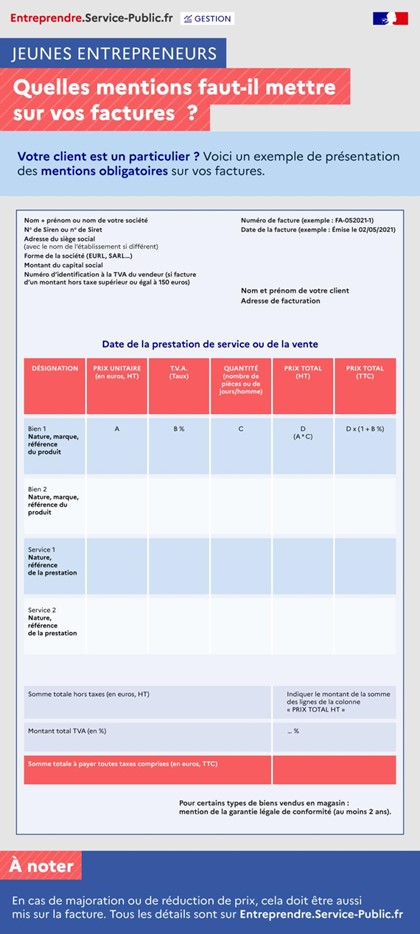

Invoices which shall comply with French invoicing rules, have to include several mandatory statements, including :

- invoice number and issuance date of invoice:

The number of the invoce does not correspond to the number of the order placed on the Platform. According to 7°th of the article 242 nonies A of annexe II of french General tax code, it is a unique number based on a chronological and continuous sequence.

The number of the invoce does not correspond to the number of the order placed on the Platform. According to 7°th of the article 242 nonies A of annexe II of french General tax code, it is a unique number based on a chronological and continuous sequence.

- statements on the parties :

- name or company name of the seller and of the client ;

- address (or registered office) of the seller and of the client ;

- VAT identification number of the seller and client (if professional) ;

- if a company, SIREN or SIRET number, mention of the legal form and the share capital (RCS number for a merchant).

- statements regarding the sale(s) :

- for each sale (if several) :

- date of the sale when different from the issuance date of invoice ;

- detailed number and description of each sold goods ;

- unite price exclusive of VAT ;

- discounts granted at the date of the sale and directly linked to this transaction ;

- applicable VAT rate or, if applicable, benefit of an exemption.

- general statements :

- total amount of VAT to be paid and, by tax rate, total excluding VAT and corresponding VAT ;

- if applicable: discounts not related to specific sale ;

- date on which payment must be made, discount conditions in case of early payment, penalties due in case of late payment.

For more information, please consult the following documentation :

- https://www.economie.gouv.fr/entreprises/factures-mentions-obligatoires ;

- https://www.economie.gouv.fr/cedef/facture-mentions-obligatoires ;

- https://entreprendre.service-public.fr/vosdroits/F31808 ;

- The following model:

|

Please note that:

We remind that, RAKUTEN’s contribution to the development of this Frequently Asked Questions (FAQ) is only a brief and non-exhaustive presentation of the legislation concerned. Therefore, this FAQ does not in any way constitute legal advice from RAKUTEN.

|